World Nomads Annual Travel Insurance Review

If you’re a frequent traveler, you know that planning multiple trips throughout the year can be a logistical challenge. There are lots of moving parts to organize, from flights to accommodation to activities. And it gets even more challenging if you’re traveling with friends or family.

In fact, there’s so much to keep track of that most people neglect one of the most important things you can take on any trip: travel insurance.

A lot of travelers avoid even thinking about travel insurance. Comparing prices and plans seems like a hassle (and an unnecessary expense to boot). After all, you probably won’t need it, and then you’ve just paid for nothing.

But you haven’t paid for “nothing.” You’ve paid for assurance that you have a plan in place should the unexpected or unfortunate happen while you’re abroad. And if something does happen, you will be very glad that you have coverage. Accidents and mishaps that happen on the road can add up quickly, leaving you hundreds (if not thousands) out of pocket.

After over 15 years of traveling the world, travel insurance is the one thing I never leave home without. It’s that important!

And while finding and comparing plans used to be time-consuming (I’ve read a lot of fine print over the years), it’s never been easier to learn about new plans. Gone are the days of having to buy a new plan for each and every trip too, thanks to the growing number of annual multi trip plans.

World Nomads, a company I’ve been recommending for over a decade, has just launched its own Annual Travel Protection Plan for US residents. Here’s everything you need to know to decide if it’s the best plan for your next journey:

What is World Nomads?

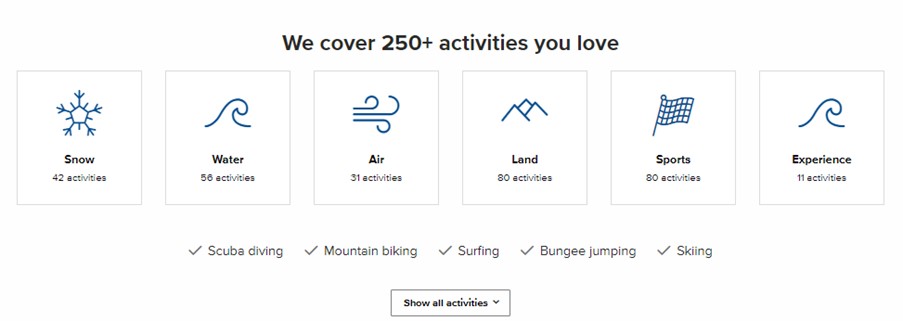

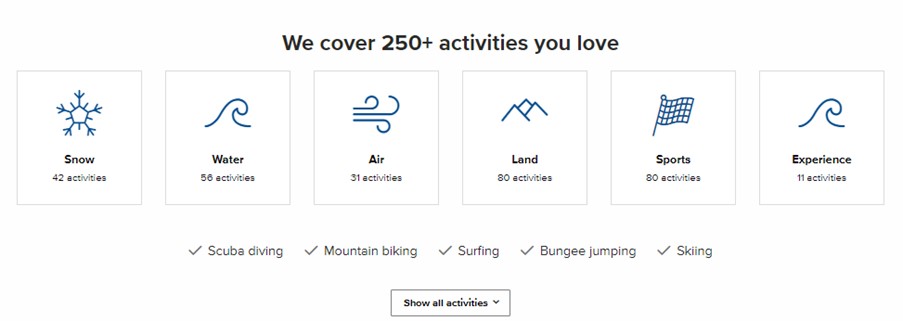

World Nomads is a travel insurance* company that started out geared towards backpackers and adventure travelers, with an extensive list of more than 250 adventure sports and activities covered. It’s the one I used on my first big trip around the world (and have used it dozens of times since).

They’ve been around for over twenty years and provide coverage for people from more than a hundred countries. Through World Nomads, you can get international and domestic coverage when traveling at least 100 miles from home for:

- Emergency medical and dental work

- Sudden illness and injury

- Medical evacuation and repatriation

- 24-hour emergency medical assistance

- Lost, stolen or damaged baggage

- Cancellations and interruptions

- Trip and baggage delay

- Over 250 types of adventure activities

- And more!

Overall, World Nomads is a solid travel insurance company for travelers who want bundled coverage. While there are cheaper plans out there, World Nomads offers multiple plans to choose from and varying levels of coverage (especially when it comes to cancellations and adventure activities).

If you’re going to be doing a lot of outdoor activities and want a variety of covered activities available, World Nomads is the company I recommend.

That said, since I’ve already covered World Nomads in depth in this review, today I’m going to focus on their new Annual Plan. It’s something that many travelers have asked me about, both in my inbox and on our travel insurance webinars. I’m glad to see they’ve created an Annual Plan to fill this need.

What is the World Nomads Annual Travel Protection Plan?

Previously, World Nomads only offered single-trip protection plans. You bought a plan for a predefined period and destination, and that was it.

But what if you travel a lot throughout the year? It’s a hassle to have to buy a new plan every time. Those single-trip plans add up too.

With World Nomads annual plans, however, you pay once and get travel protection for multiple countries, and for an unlimited number of trips up to 45-days long through the entire year. This not only simplifies your planning but could save you money in the long run.

There are four caveats though.

First, each trip under the annual plan is capped at 45 days. Most travelers don’t travel abroad for that long, though, so I don’t really consider that a negative.

Second, annual plans do not auto-renew, so you’ll need to purchase a new plan each year. That said, World Nomads sends a reminder a month before your current plan expires, so this isn’t really a big deal either.

Third, the US Annual Plan is only available to be purchased independently per traveler. The plan is not available for family or couple purchases like the single trip plans; however, you can purchase individual Annual Plans for each member of your family under the age of 69.

Fourth, and most important, the Annual Plan is currently only available to US residents (except residents of Missouri, Montana, New York or Washington). World Nomads also offers a similar Annual Multi Trip plans for UK and Ireland residents, but coverages vary compared to the US plan. Hopefully, if it’s successful, they will expand it to more countries in the future.

What does World Nomads’ Annual Travel Protection Plan cover?

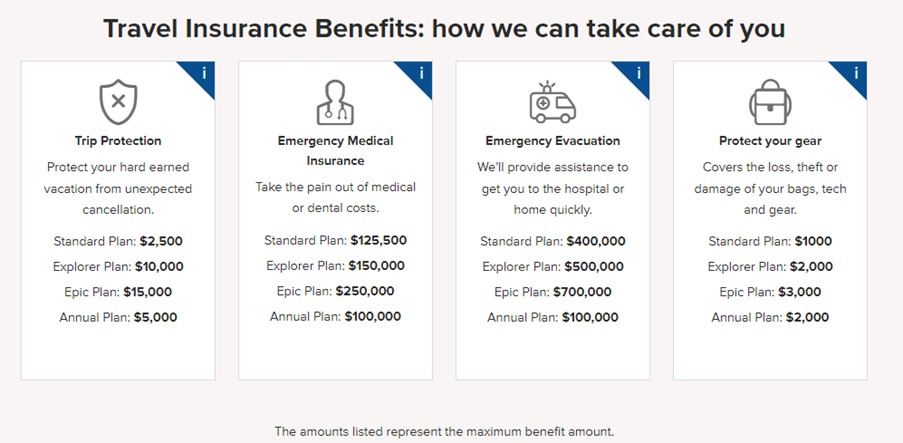

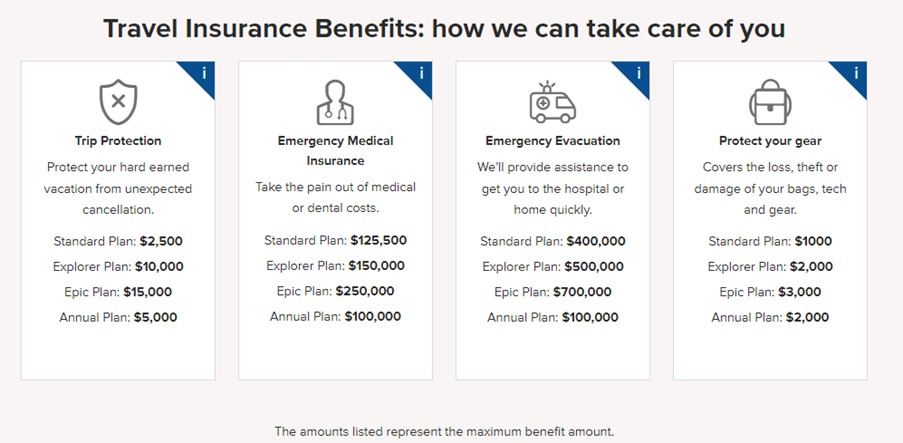

The coverage under a World Nomads Annual Plan is similar to that of its single-trip plans. As a plan holder, you’ll get coverage for more than 250 adventure activities, trip cancellation, emergency medical expenses, and some for lost and stolen gear.

Here’s exactly what’s covered found on the World Nomads website:

The plans also cover incidents that occur while you’re participating in any of 250+ adventure activities in the following categories:

Most activities are included in the Annual Plan. More extensive activities could be covered on the single trip Explorer and Epic Plans. To give you an example, zip-lining and snorkeling are covered by Standard and Annual plans, while heli-skiing is covered by the Explorer plan and free soloing is only covered by the Epic Plan.

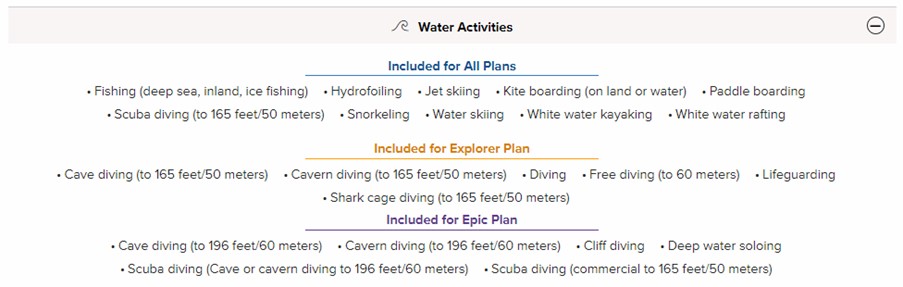

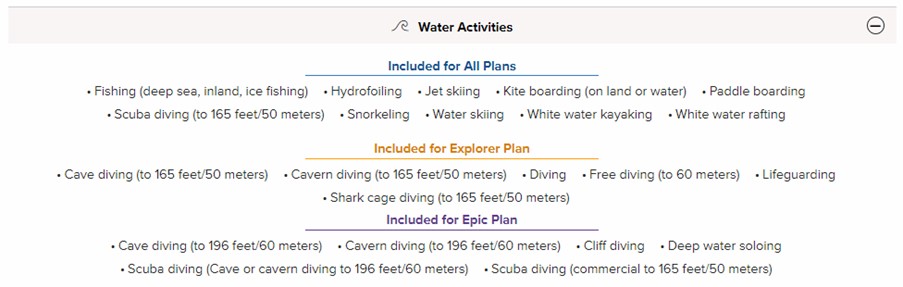

Here are all the water-related activities that World Nomads covers:

Of course, there are also things World Nomads does not cover. These include (but aren’t limited to):

- Engaging in any illegal activities

- Incidents that occur when under the influence of alcohol or other drugs

- Non-emergency medical treatment that can wait until you return home

In short, World Nomads offers travel insurance, not health insurance. It’s there for when the unexpected happens, not for ongoing treatment or checkups.

Additional Perks for all USA Travel Protection Plans

In addition to rolling out the new annual plan, World Nomads is expanding the non-insurance services included within all USA travel protection plans.

- 24/7 Emergency Assistance supports you in emergency situations, 24 hours a day, 7 days a week. The support team can get you to the nearest hospital or consulate, offer translation services and provide guidance in emergency situations.

- FootPrint ID allows to you to keep track of your medical records and emergency contacts in one place. This is helpful in emergency situations when healthcare providers need quick answers regarding your medical history, prescriptions and contacts.

- Blue Ribbon Bags offers delayed and lost luggage retrieval services. They can track and expedite the return of delayed airline baggage for outbound flights and are available to assist 24/7.

- Runway Health provides free pre-trip online health consultations so travelers can get access to prescriptions and vaccinations for common travel needs like altitude sickness and malaria before taking off for their trip.

Pros of World Nomads’ Annual Travel Protection Plan

- Covers you for an unlimited number of trips within a year

- Cost-effective and convenient (you don’t have to buy a new plan for each trip)

- Coverage for over 250 activities

- Coverage for domestic and international travel

- Access to 24/7 Emergency Assistance, FootPrint ID, Runway Health and Blue Ribbon Bags

- Online claims processing

Cons of Annual Multi-Trip Travel Insurance

- Per trip duration limit of 45 days

- Higher up-front cost than purchasing plans individually

- Only available for individual purchase, no family or couple plans

- Only available for USA, UK & Irish residents at this time

Comparing Annual and Single-Trip Plans

The cost-effectiveness of annual versus single-trip insurance depends on your habits. If you take multiple trips each year, both domestically and internationally, 12-month travel insurance could save you money.

Let’s say that within a year, you plan to travel to Thailand for three weeks, Paris for a long weekend, Mexico for one month, the Bahamas for 10 days, Iceland for a long weekend, and then Spain for a week. If you got annual travel insurance, the quote for a 40-year-old person from the US would be $506 USD. Not bad at all for an entire year’s worth of coverage (that’s just over $42 USD per month)!

If you were to get separate policies for each trip, it would total around $635 USD. Not to mention the added convenience of only having to buy the plan once and get coverage for the entire year. Plus, you’d still be able to go on more trips (or extend your trips) with the annual plan without spending more money!

While prices vary depending on factors such as where you’re going, the length of the trip, and your planned activities, most of the time, it’s a no-brainer to get the annual plan. It’s just so easy and hassle-free.

Both annual and single-trip plans offer the same benefits too. That includes trip cancellation, emergency medical expenses, and personal baggage coverage.

Remember, limits and exclusions may vary. No matter what plan you get, it’s essential to review the plan details carefully.

Who is World Nomads Annual Plan for?

World Nomads annual plan is best for frequent travelers who take several trips throughout the year. You can sign up for a plan once a year, and then go about your travels without thinking about it again. Simply purchase a new plan when the time comes (you’ll get an email reminder).

Personally, I think a lot of travelers who do lots of short weekend trips will find this plan super helpful, as you won’t have to purchase a plan every single time you want to get away. The saved time and money alone make the annual plan worth it, in my opinion.

That said, annual plan is not ideal for full-time digital nomads, since each trip is capped at 45 days. Additionally, World Nomads only covers unexpected emergencies, so if you’re a digital nomad looking for ongoing health insurance (i.e., for non-emergencies), you’ll want to look elsewhere.

Having used World Nomads for over 15 years, I think these new additions are a game changer. While they are only available in the US, UK and Ireland currently, I’m super excited to see what direction the company is moving in. Baggage retrieval service, pre-trip online health consultations — these are awesome perks that I know every traveler is going to appreciate.

Don’t let the hassle of arranging travel insurance for each trip hold you back from exploring the world. Get a quote for World Nomads’ Annual travel insurance plan today and enjoy coverage all year round. Safe travels!

*Travel insurance is included as part of the World Nomads travel protection plan which contains both insurance benefits and non-insurance assistance services. U.S. travel protection plan are serviced by their partner Trip Mate, a Generali Global Assistance & Insurance Services brand, who administers both customer service and claims for U.S. customers.

Book Your Trip: Logistical Tips and Tricks

Book Your Flight

Find a cheap flight by using Skyscanner. It’s my favorite search engine because it searches websites and airlines around the globe so you always know no stone is being left unturned.

Book Your Accommodation

You can book your hostel with Hostelworld. If you want to stay somewhere other than a hostel, use Booking.com as it consistently returns the cheapest rates for guesthouses and hotels.

Don’t Forget Travel Insurance

Travel insurance will protect you against illness, injury, theft, and cancellations. It’s comprehensive protection in case anything goes wrong. I never go on a trip without it as I’ve had to use it many times in the past. My favorite companies that offer the best service and value are:

Want to Travel for Free?

Travel credit cards allow you to earn points that can be redeemed for free flights and accommodation — all without any extra spending. Check out my guide to picking the right card and my current favorites to get started and see the latest best deals.

Need Help Finding Activities for Your Trip?

Get Your Guide is a huge online marketplace where you can find cool walking tours, fun excursions, skip-the-line tickets, private guides, and more.

Ready to Book Your Trip?

Check out my resource page for the best companies to use when you travel. I list all the ones I use when I travel. They are the best in class and you can’t go wrong using them on your trip.