Why the Amex Platinum card is best card for active duty military

I have my nine years of active-duty service in the Navy (Beat Army!) to thank for getting me interested in points and miles. Traveling and moving all the time was hurting my family’s wallet, and I knew there had to be a better way to cover some, if not all, of our travel expenses.

Among the many travel strategies and benefits I took advantage of during my service, one of the best was getting and maximizing The Platinum Card® from American Express, which I continue to have and use to this day. While the Amex Platinum normally has a $695 annual fee (see rates and fees), the true out-of-pocket annual fee for those on active duty is $0. Here’s how that works and what makes this card one of the most beneficial for active-duty military members.

Why the Amex Platinum is the best card for military members

The Amex Platinum is revered in military circles because its high $695 annual fee (see rates and fees) is waived each year you’re on active duty. Plus, the card comes with perks that align nicely with the needs of those in the military. For example, the Amex Platinum gets you into American Express Centurion lounges and Priority Pass lounges, comes with multiple annual credits valid toward airlines and Uber, provides credits you can use toward streaming services and more. Enrollment is required in advance for some benefits.

Additionally, this card elevates your hotel elite status to Gold with programs such as Hilton Honors and Marriott Bonvoy when you enroll.

American Express waives the annual fee not only for Amex cards — such as the Amex Platinum — but also for any accounts when an active-duty member is registered as an authorized user, including on your spouse’s account. With the Amex Platinum, that’s a savings of $195 a year per authorized user you add — up to three per main account (see rates and fees).

As a result, my fellow officers all became familiar with the card and carried it themselves. We even had office pools where we rotated referral links so the new person coming to the office could apply, and one of us would earn a referral bonus.

Amex Platinum benefits

Now, let’s dig into some of the top benefits that come with being an Amex Platinum cardholder.

Delta Sky Club access

Because of the Fly America Act, and the rule that all official federal government travel must be booked through the Defense Travel System, Delta is often the airline for your official government travel. When you’re flying on a Delta-operated flight and have the Amex Platinum in your wallet, you get Delta Sky Club access on your day of travel (limited to 10 annual visits from Feb. 1, 2025).

Amex Centurion Lounge

If you’re not flying on Delta and your airport has one of these Amex Centurion Lounges, they’re also an excellent option to visit before or between flights since your Amex Platinum card will get you in — regardless of what airline you’re flying that day.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Centurion Lounges has an impressive list of 25+ locations throughout the U.S. and globally, with some notable locations such as Dallas (DFW), London (LHR), Los Angeles (LAX), Hong Kong (HKG), Seattle (SEA), and Miami (MIA)

Cardholders can enjoy complimentary amenities such as seasonally-inspired food from renowned local chefs, signature cocktails, premium spirits and curated wines. Some lounges offer spa services, wine-tasting areas, family rooms and shower suites as well.

Priority Pass membership

U.S. military personnel travel the world, requiring more than just Delta Sky Club access for comfort. A Priority Pass membership allows you and two guests to enter any of the 1,500-plus Priority Pass lounges for no additional charge. I was consistently pleased to find a Priority Pass lounge in almost every airport the Navy required me to visit across Asia and the Middle East. Enrollment required for select benefits.

Up to $200 in Uber credit

In order to go out and enjoy yourself while traveling, all ranks in the military are required to have a plan to avoid potential DUI situations. Uber comes in handy here, and it’s even better when you have up to $15 in Uber credit every month (with up to $20 credit in December) courtesy of your Amex Platinum. Credits are only good for use in the U.S. (one of my biggest pet peeves right now with Uber), and they do not carry over to the next month. They can also be used toward Uber Eats if you don’t need or want a ride that month. Enrollment required.

Up to $200 in airline credits

Every calendar year, you receive up to $200 in statement credits from a participating airline of your choice to cover any incidental fees — such as checked bags and inflight food and beverage — you charge to your Amex Platinum. I view this benefit as the icing on the cake for the Amex Platinum when you aren’t paying an annual fee. Enrollment required for select benefits.

Hotel elite status

Hilton Honors Gold and Marriott Gold status come with being an Amex Platinum cardholder. These will make your hotel stays worldwide more comfortable, may score you breakfast in some Hilton properties, and should give you bonus points in your hotel loyalty accounts on government-paid room nights.

Remember, you have to use your Government Travel Charge Card to pay for the room. This means you won’t earn points via your credit card, but you can keep the points earned for staying the night in your hotel account. Enrollment is required for select benefits.

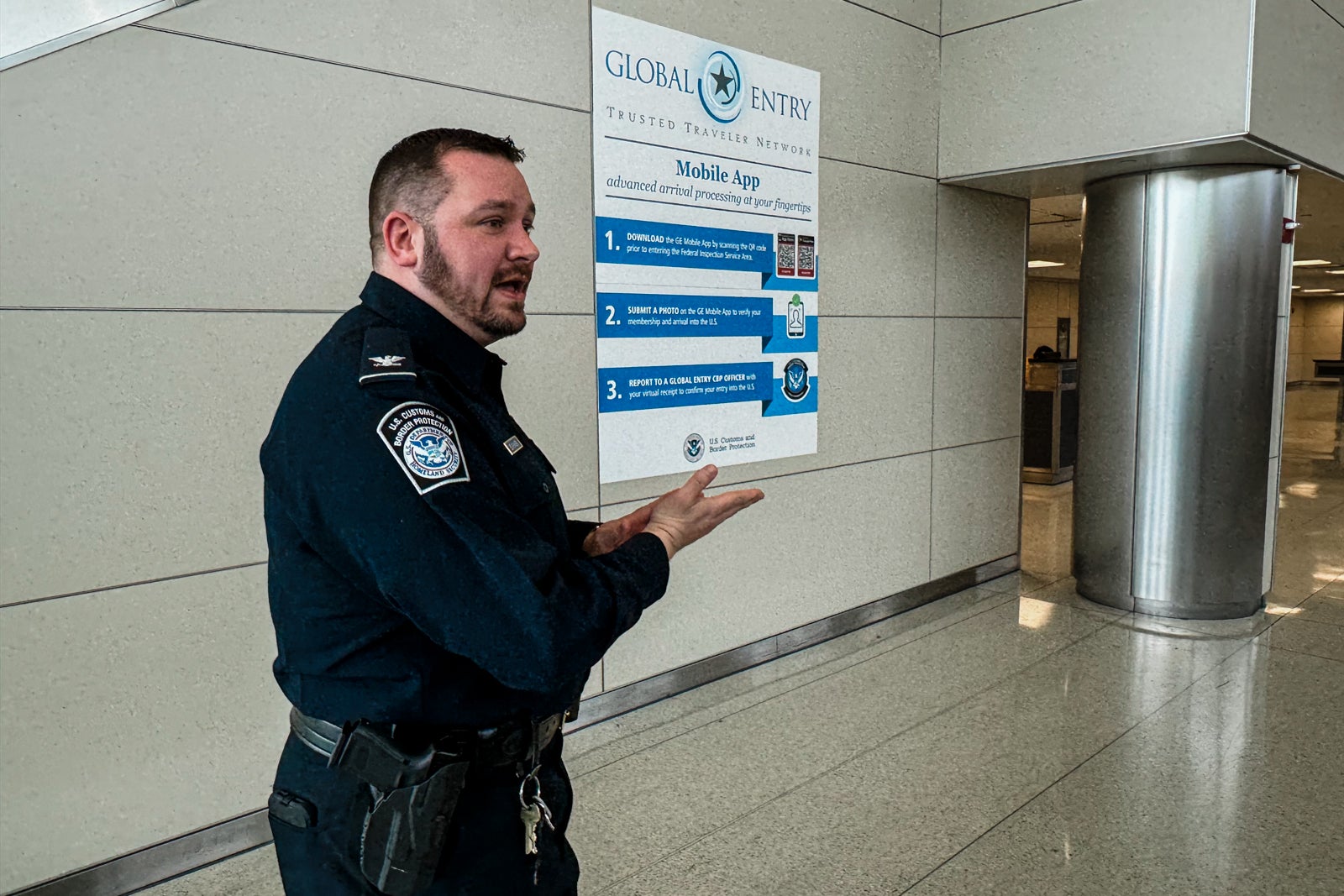

Up to $100 Global Entry/TSA PreCheck credit

If you’re in the military, you need Global Entry. If you stay in service for more than a few years, you’ll travel internationally, and there’s a good chance it will be via commercial air.

With Global Entry, you skip the immigration line upon returning to the U.S. You can be reimbursed for your application fee if you pay with your Amex Platinum card, which offers a statement credit of $100. Keep in mind the application fee for Global Entry is jumping up to $120, so you’ll still be on the hook for the remaining $20. You’ll be reimbursed once every four years for the fee. If you already have Global Entry, use it to sign up a friend or family member for free.

The Servicemembers Civil Relief Act and Military Lending Act

The ability to get cards such as the Amex Platinum without paying an annual fee during active duty service is largely thanks to the Servicemembers Civil Relief Act (SCRA) and the Military Lending Act (MLA). SCRA offers financial and legal protection for, among other things, credit cards, mortgages and taxes. Some of the most important of these benefits include:

- Reduced interest rates. The interest rate on debt — including credit cards, car loans, business obligations and some student loans, as well as fees, service charges and renewal fees — is cut to 6 percent for anything incurred before entering active-duty service. For mortgages, the lower interest rate extends for a year after active-duty service.

- Foreclosures are postponed. No sale, foreclosure or seizure of property for nonpayment of pre-service mortgage debt is allowed if done during or within nine months after your service on active duty, unless there’s a valid court order. This is especially helpful in states that allow foreclosures to proceed without involving the courts.

- Deferred income taxes. The Internal Revenue Service, along with state and local taxing authorities, must defer your income taxes due before or during your military service if your ability to pay is materially affected by military service. Also, no interest or penalty can be added because of this deferral.

- Protection for small-business owners. If you own a small business, your nonbusiness assets and military pay are protected from creditors while you’re on active duty. This also applies to business debts or obligations.

- Termination of automobile leases. You may terminate an automobile lease under circumstances that include: signing a lease agreement before being called to active duty; signing an agreement and then receiving permanent change-of-station orders outside the continental U.S.; or signing an agreement and then receiving orders to deploy.

The MLA protects service members as well as their dependents from certain lending practices. The highlight of the MLA is the implementation of the Military Annual Percentage Rate (MAPR) regulation. This prevents creditors from exceeding 36% annually in total credit-related charges to covered borrowers under the MLA.

The MLA has been amended multiple times since it was enacted in 2006. This expansion of covered services prompted many credit card companies to waive annual fees in order to avoid complications.

Whether your annual fee is waived based on the SCRA or MLA depends on the time you apply for the card versus when you entered active service. If you held the card prior to active service, your fee is waived based on the SCRA. If you apply for the card after you are active duty, you need to request relief under the MLA.

You can request Amex SCRA benefits online but must call or chat with an Amex rep to request MLA benefits.

When should you apply for the Amex Platinum?

The Amex Platinum is one you can utilize and maintain throughout your military service with no annual fee. However, if you’re on active duty and planning to maximize your credit card benefits, consider your Chase 5/24 status first, ensuring you have a path to earn valuable Chase Ultimate Rewards points.

Applying for the Amex Platinum will add to your 5/24 standing, so keep that in mind if you’re also interested in getting other cards in the near future.

Other military-friendly Amex cards

American Express® Gold Card

Like the other Amex cards, this card’s $250 annual fee (see rates and fees) is waived for active-duty military personnel.

The card earns a generous 4 points per dollar spent at restaurants and at U.S. supermarkets (up to $25,000 in purchases per calendar year, then 1 point per dollar), 3 points per dollar on flights booked directly with an airline and 1 point per dollar on everything else.

Receive up to $120 in annual dining credits with select merchants. The card also has a $10 monthly credit you can use towards Uber or Uber Eats in the U.S. (up to $120 annually). That puts the card at $240 in annual credits dolled out in monthly increments. The card must be added in your Uber app to receive this benefit. Enrollment required for select benefits.

Delta SkyMiles® Reserve American Express Card

The card’s $650 annual fee (see rates and fees) is waived for active-duty members. Right now, new card members receive 95,000 bonus miles after spending $6,000 in purchases on the card in the first six months of membership.

The card also gives you an annual companion pass valid on select flights in Main Cabin, Comfort+ or first class at each renewal, 20% off in-flight purchases, and gets the cardholder into the Delta Sky Club when flying Delta (limited to 15 annual visits from Feb. 1, 2025).

Hilton Honors American Express Aspire Card

The Hilton Aspire card awards more credits each year than the $550 annual fee costs (see rates and fees), even if you had to pay the annual fee. The card offers instant Hilton Diamond elite status, up to three free reward nights a year, and National Car Rental elite status.

It also awards up to $200 in airline credits each year and up to $400 in annual resort credits at Hilton properties. Enrollment required for select benefits.

The information for the Hilton Aspire Amex card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Marriott Bonvoy Brilliant® American Express® Card

The card’s $650 annual fee (see rates and fees) is waived for military members, and the current welcome offer is for 95,000 bonus points after you spend $6,000 in purchases within the first six months of card membership.

This card awards 6 points per dollar of eligible purchases spent at hotels participating in the Marriott Bonvoy program, 3 points per dollar at restaurants worldwide and on flights booked directly with an airline and 2 points per dollar on all other eligible purchases. Perks include an up to $300 annual statement credit on eligible spending with the Bonvoy Brilliant at restaurants (up to $25 in monthly dining credits), an annual free award night (worth up to 85,000 points) every card anniversary, and Platinum Elite status.

Bottom line

I’ve had the Amex Platinum Card since 2012 and was sad when I saw the annual fee for the first time after leaving the Navy.

Every time I use my card now, it reminds me of the years of value my wife and I received from the card all around the world — for absolutely nothing out of our pockets. There are several other benefits not listed above for the card, and these could also provide significant value based on your own individual situation, but the bottom line is that those who are active duty military may be well served to get the Amex Platinum and enjoy all the perks while not paying an annual fee.