Which card should I pay with when dining at a hotel?

One of the best problems to have in the points world is trying to figure out which credit card bonus category will give you the most bang for your buck on a certain purchase.

When dining at a hotel, this can be especially tricky — should you use a card that earns bonus points on dining or hotel purchases?

Let’s jump into questions that can guide you on which card you should use when dining at a hotel.

How does the eatery code?

Bars and restaurants at hotels can be tricky because sometimes they code as hotel or travel purchases and sometimes as dining. For most issuers, if a restaurant or bar is located inside another business, such as a hotel, it will code as a hotel or travel purchase.

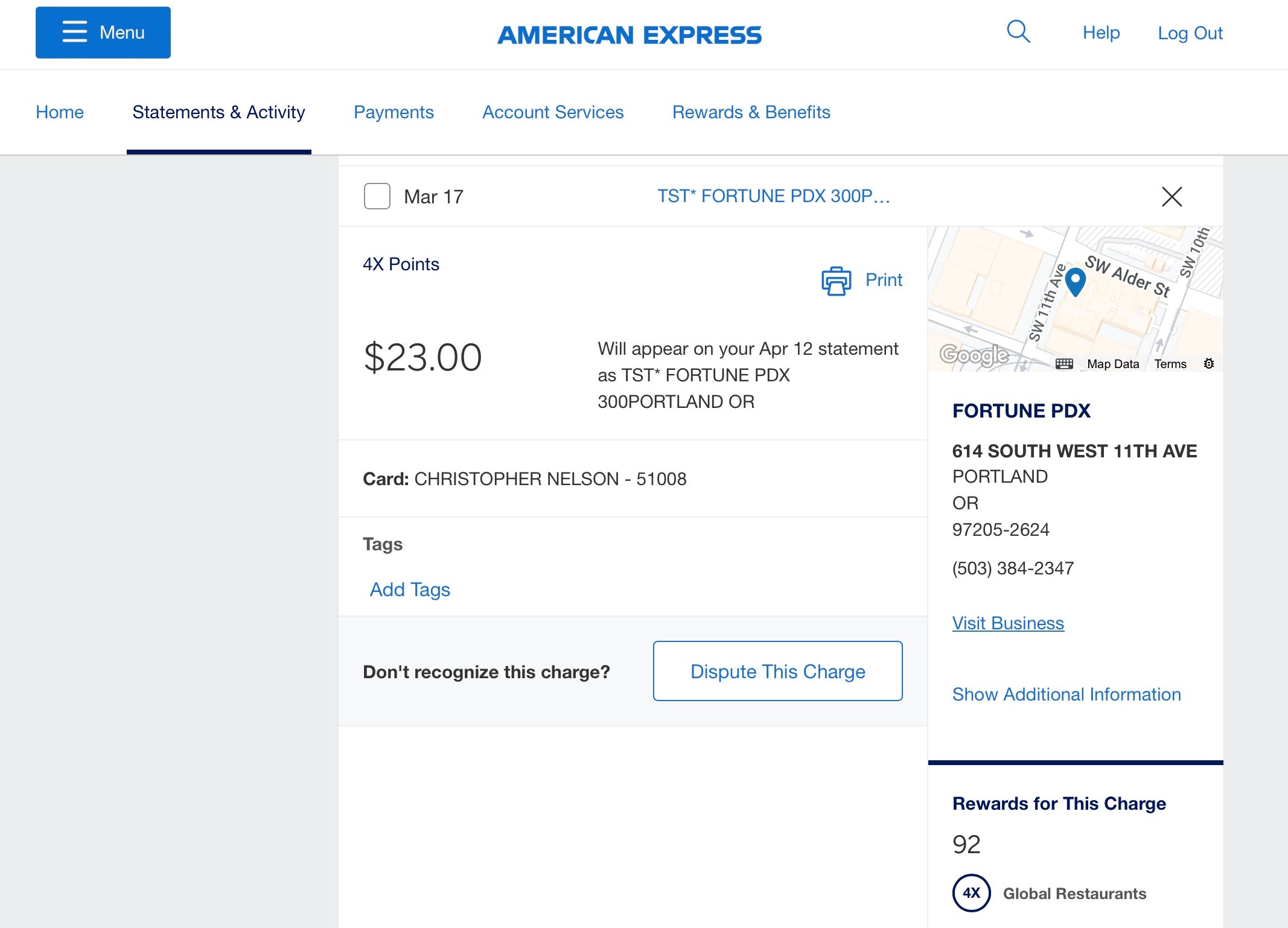

However, I recently popped into a bar attached to a hotel I was not staying at. I used my American Express® Gold Card and it coded as dining at a restaurant, so I earned 4 points per dollar spent.

So, each restaurant or bar attached to a hotel can code differently on a case-by-case basis. I have noticed that if the restaurant or bar is a chain, it tends to code as dining.

If you’re unsure how the eatery will code, a safe bet is to use a card that earns bonus points on both dining and hotel purchases, such as the Chase Sapphire Preferred® Card or Chase Sapphire Reserve®.

Related: The best credit cards for dining

Are you staying at the hotel?

If you are staying at the hotel and don’t want to take a chance on how the restaurant will code, your best option is to charge your meal to your room. Then, your restaurant or bar bill will be added to your overall hotel bill, ensuring that it will code as a hotel expense.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

If you have a card that earns bonus rewards on travel but not dining, like the Ink Business Preferred® Credit Card, this is a good way to make sure you’ll earn bonus rewards on your dining purchase.

And if you have a cobranded credit card with the hotel, you’ll earn bonus points on the purchase and may even tap into additional perks like a dining discount. For example, using a Marriott cobranded card at a Bonvoy property could allow you to earn up to 23 points dollar.

While spending on cobranded credit cards doesn’t always make sense, one of the best reasons to do so is to rack up large bonus multipliers on hotel stays.

Related: How to choose a hotel credit card?

Should I use my dining card or my hotel’s cobranded credit card?

If you have a card with great earning rates on dining, like the Amex Gold Card, it can be tempting to use it to pay at your hotel restaurant and earn valuable transferable rewards rather than hotel points. However, most cobranded cards have outstanding earning rates for purchases at their hotels, so you’ll almost always come out ahead by charging the meal to your room and paying with your cobranded hotel card when you can.

For instance, if you take a chance that the restaurant will code as dining and use your Amex Gold to pay your bill, you stand to earn 4 points per dollar on that purchase — an 8% return, according to TPG valuations. But if you take that chance and the purchase codes as a hotel instead of a restaurant, you’ll only earn 1 point per dollar.

If, however, you charge the bill to your room and pay with your cobranded hotel card, you’ll ensure that you get your card’s bonus-earning hotel rate for the purchase.

Related: Marriott Bonvoy Boundless credit card review: Worth keeping year after year

Understanding bonus multipliers

If you’re a hotel elite and staying at the property you’re dining at (as opposed to just popping in for drinks), you’ll earn elite bonus points on your entire folio in addition to the points from the credit card spending, giving you even more reason to charge your dining bill to your room.

For Marriott, that breaks down as follows:

- General members: 10 points per dollar

- Silver: 11 points per dollar

- Gold: 12.5 points per dollar

- Platinum: 15 points per dollar

- Titanium and Ambassador: 17.5 points per dollar

And since most cobranded hotel cards include a level of elite status, you’re almost always better off charging your meal to your room and using your hotel card to pay the full folio at the end of your stay.

For instance, the Marriott Bonvoy Brilliant® American Express® Card comes with automatic Platinum Elite status. If you charge your meal to your room and pay for your stay with your Brilliant card, you’ll get a total of 21 points per dollar — 15 for your elite status and 6 for paying with your Brilliant.

According to our valuations, those 21 points per dollar equate to over a 17% return — much higher than even the best dining card in your wallet.

The bonus multiplier structure is similar for chains such as IHG, Hilton and Hyatt. The higher your status, the more bonus points you will earn.

Related: Comparing the best hotel elite status tiers and how to earn them

Bottom line

When dining at a hotel you aren’t staying at, your safest option is to use a card that earns bonus rewards on both dining and travel purchases, so you get a great earning rate regardless of how the bill codes. But if you’re staying at the hotel, you’ll likely want to charge the bill to your room and use a cobranded hotel card or other card that earns bonus rewards on travel purchases.