The complete guide to Amex’s one-bonus-per-lifetime restrictions

American Express has rewards credit cards with generous welcome offers and worthwhile benefits. Although Amex doesn’t impose a hard rule like Chase’s 5/24, the issuer is fairly restrictive regarding application rules and lifetime limitations on their cards.

Not only does American Express limit the number of cards you can have and how often you can apply, but it also tries to ensure that applicants are only eligible for one welcome offer per lifetime on each of their card offerings. This makes it critical to carefully choose when you apply for a new Amex card, as doing so may disqualify you from receiving an even higher welcome offer in the future.

And, since the second half of 2023, Amex has rolled out new restrictions to discourage those holding more premium cards from earning welcome offers on lower-tier cards.

Here’s what you need to know about Amex’s one-welcome-bonus-per-lifetime policy.

What is the Amex once-per-lifetime rule?

More than a decade ago, American Express would allow you to earn welcome offers on the exact same card multiple times. However, since 2014, the issuer has clamped down on applications and limited customers to one bonus per card per lifetime, regardless of how much time had passed since they last applied for that card.

In other words, you can apply for The Platinum Card® from American Express and earn a welcome offer once and only once. If you open the offer details link on the card’s application page, you’ll see the following language:

“Welcome offer not available to applicants who have or have had this Card or previous versions of the Platinum Card.”

The current bonus on the card is a generous 80,000 Membership Rewards Points after you spend $8,000 on purchases within the first six months of card membership. However, you could be targeted for a higher welcome offer through the CardMatch tool (offer subject to change at any time). As a result, if you apply for the 80,000-point offer and receive a higher one at a later date, you’ll almost certainly be ineligible for it.

New card family restrictions

An expansion to the once-per-lifetime rule is being rolled out across some families of Amex credit cards. In simple terms, Amex will most likely disqualify you from receiving the welcome offer on lower-tier cards if you’ve previously held the higher-tier cards within the same card family.

Amex seems to be progressively rolling this out to more products to prevent people who hold higher-tier cards from applying for lower-tier cards in the same family just for the welcome offer.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

The most recent addition to this list is the American Express® Green Card. As of February 2024, the welcome offer eligibility terms now state:

“You may not be eligible to receive a welcome offer if you have or have had this Card, the Platinum Card®, the Platinum Card® from American Express Exclusively for Morgan Stanley, the Platinum Card® from American Express Exclusively for Charles Schwab, the American Express® Gold Card or previous versions of these Cards.”

Similarly, in October 2023, American Express introduced a restriction on the American Express® Gold Card. If you’ve had the more expensive Amex Platinum card, you won’t be eligible for the welcome offer on the Gold card.

And in September 2023, American Express introduced a family rule on personal Delta credit cards. For example, one of the strictest family rules can be found on the no-annual-fee (see rates and fees) Delta SkyMiles® Blue American Express Card: You may not be eligible to receive a welcome offer if you have or have had the Delta SkyMiles® Gold American Express Card, the Delta SkyMiles® Platinum American Express Card, the Delta SkyMiles® Reserve American Express Card or previous versions of these cards.

The information for the Amex Green, Amex Platinum Exclusively for Morgan Stanley and Amex Platinum Exclusively for Charles Schwab cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Caveats

There have been reports of people getting approved and earning the welcome offer again several years later. Additionally, you may be approved for the bonus if the offer terms don’t include the above language about previously having the card.

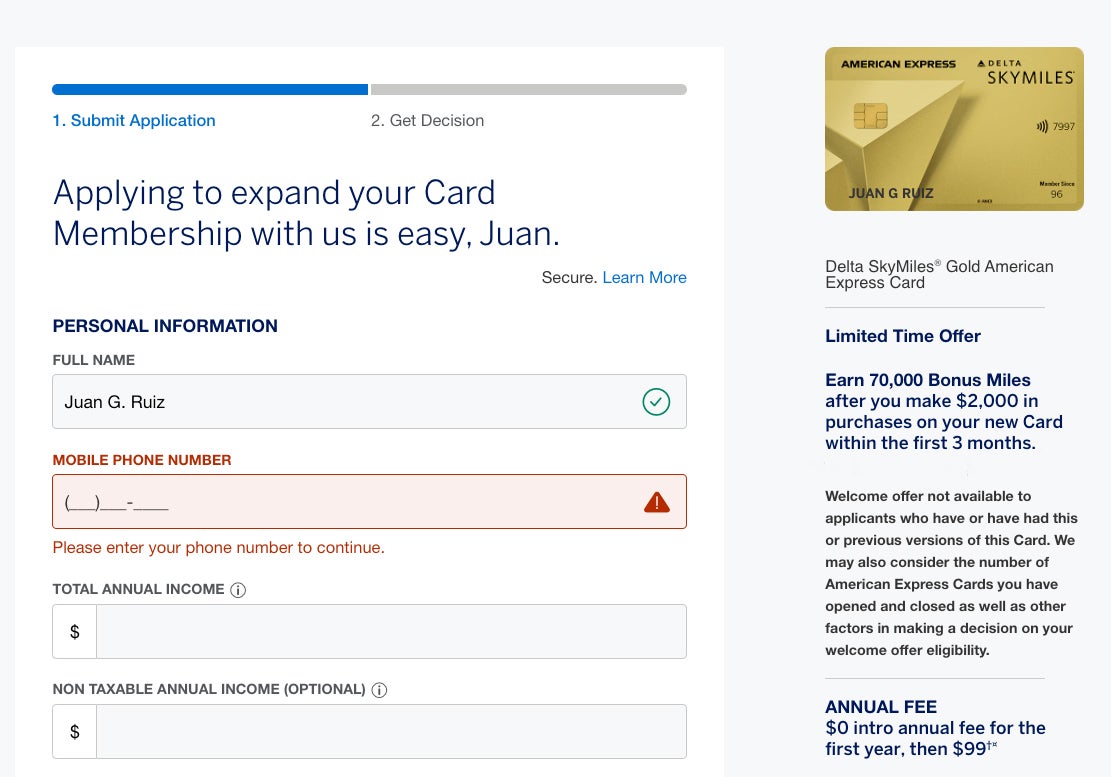

Finally, American Express gives you a warning as part of its online card application process. If Amex deems you are not qualified for the card’s welcome offer, you will likely see a pop-up box stating so.

In general, though, the issuer’s one-bonus-per-lifetime rule was implemented to discourage applicants from applying for Amex cards solely for the welcome bonuses.

Related: Choosing the best American Express credit card for you

What cards are affected by this rule?

This rule covers all of Amex’s cards. American Express maintains a strict rule of one bonus per card for life regardless of the family of cards (cobranded hotel and airline, business, cash-back and rewards cards).

Although this rule covers all Amex cards, you can earn a welcome offer on personal and business cards of the same type.

For example, the American Express® Gold Card and American Express® Business Gold Card are from the same card family, but one is a personal card and the other a business card. Amex allows you to earn the welcome offer for each card — as long as you have never been a cardholder of that card in the past.

Note that this also applies to rebranded or updated cards. For many years, the Amex Gold was called the Premier Rewards Gold Card, and the current offer — 60,000 points after you spend $6,000 on purchases on your new card in your first six months of card membership — explicitly references that older product:

“Welcome offer not available to applicants who have or have had this Card or the Premier Rewards Gold Card.”

Related: Credit card showdown: Amex Gold vs. Amex Business Gold

How many Amex cards can I have?

Officially, American Express does not have a cap on the number of cards you can have. However, the unofficial policy from Amex says that most cardmembers will be restricted to at most five Amex consumer and business credit cards. They’ll also be limited to 10 Amex cards with no preset spending limit (formerly known as charge cards). This latter category includes the Amex Gold and Amex Platinum.

For example, TPG director of content Nick Ewen has the following American Express cards currently open:

The information for the Hilton Honors Aspire has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Since five of the seven are credit cards, he has reached his cap on credit cards with Amex.

Related: Chase’s 5/24 rule: Everything you need to know

How do I know if I qualify for an Amex welcome offer?

Tracking which Amex cards you have applied for in the past will give you a better idea if you are eligible for a certain card’s welcome bonus or not. If your organizational skills aren’t up to par, don’t fret — American Express has a welcome bonus qualification tool to warn applicants if they are ineligible for one. Here’s how it works:

When you apply for an American Express card that you’ve already had in the past, you’ll receive the following message before your credit is pulled:

Because you have or have had The Platinum Card, you are not eligible to receive the welcome offer.

We have not yet performed a credit check. Would you still like to proceed?

In essence, if you think you had a card before and thus are not sure if you’re eligible for the welcome offer, Amex should alert you with a pop-up message when you apply.

There is a possible exception to the rule for Amex welcome offers. Typically, you’ll see the verbiage noted above on the landing page of an application:

Welcome offer not available to applicants who have or have had this Card.

If your card application does not include this restrictive language, but you have had the card in the past, this could mean that you’ve been targeted for the card by American Express and are eligible for the offer. Check your email for targeted offers or log into your American Express account and look for pre-approved offers with no lifetime language.

Just double-check before submitting your application for the pop-up message by Amex alerting you if you are ineligible for the welcome bonus. Taking a screenshot just before clicking apply is also a good idea. That could help if you run into issues receiving the bonus after you meet applicable spending requirements.

Other Amex welcome offer restrictions

Although American Express has restricted welcome offers to one bonus per lifetime per card, cardholders can still apply and get approved for a card without the welcome offer. The language in the offer terms highlights the ineligibility of the welcome offer, but it typically doesn’t restrict approval.

However, it’s also worth pointing out the additional verbiage from the above screenshot:

“We may also consider the number of American Express Cards you have opened and closed as well as other factors in making a decision on your welcome offer eligibility.”

This overly broad statement retains Amex’s ability to use additional factors from your credit report and history with the issuer to determine if you qualify for an offer. This shouldn’t impact most applicants — but if you’ve shown a pattern of opening cards, earning welcome bonuses and then canceling those cards after just one year, that could be a red flag.

Given the wide range of American Express card offerings and once-per-lifetime restrictions, you should time your applications strategically to ensure you get the highest possible welcome bonus. Don’t forget to check the CardMatch tool to know if you qualify for a possible targeted up to 150,000 Membership Reward points on the personal version of the Amex Platinum and a 75,000-point targeted offer on the Amex Gold (offers subject to change at any time).

Related: The ultimate guide to credit card application restrictions

Bottom line

American Express has an impressive portfolio of cards with generous welcome offers for first-time applicants. Their once-per-lifetime rule, although restrictive, has certain exceptions that may allow customers to earn a welcome offer again after some time. Along with the welcome bonus qualification tool, Amex makes it easy for applicants to track and understand their eligibility for welcome bonuses on American Express cards.

Related: Which is the best American Express credit card for you?

For rates and fees of the Delta SkyMiles Amex Blue Card, click here.