The best credit cards for pet expenses

If you have a furry friend, you would probably do just about anything for them — including shelling out for things like treats and fluffy beds in addition to their necessary food and vet expenses.

And if so, you’re not alone. One study estimates that cat and dog owners spend an average of over $600 and $900, respectively, on pet expenses each year.

It hurts us to see people earning just one point per dollar on their pet expenses. So below, we’re sharing our favorite credit cards and strategies for earning bonus points on our pet purchases.

The best credit cards for pet expenses

A credit card that earns bonus points in certain categories

If you have a card that earns bonus points at supermarkets, your best bet is to get essentials like food and treats where you get your groceries. And if you have a card with rotating categories, such as the Chase Freedom Flex®, you can probably get your pet’s basics from a store that earns bonus categories most quarters, such as supermarkets, Amazon or Target.

TPG credit cards writer Olivia Mittak got 8 points per dollar on pet expenses by taking advantage of the Q2 category on her Freedom Flex. Purchases made from pet stores through DoorDash code as dining on Chase cards. With dining being one of the Q2 rotating bonus categories, she got an additional 5 points per dollar on top of the 3 points she normally would earn.

Olivia holds the Chase Sapphire Preferred® Card, so she can pool her Freedom Flex rewards with her Sapphire Preferred as Ultimate Rewards points.

Many pet expenses don’t fit into card bonus-earning categories, so you’ll want to use a card with a solid flat earning rate for other things like vet expenses, boarding and grooming.

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards is a great catch-all card since it earns 2 miles per dollar on every purchase.

Welcome bonus: Earn 75,000 bonus miles after spending $4,000 on purchases within the first three months from account opening. Plus, earn a $250 Capital One Travel credit upon account opening to use in the first cardholder year.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

As of July 2024, TPG values Capital One miles at 1.85 cents per mile. When adding together the value of the miles plus the Capital One Travel credit, this welcome bonus is worth $1,638.

Annual fee: $95 (see rates and fees)

Why we like it: With this card, you’ll earn an unlimited 2 miles per dollar on every purchase.

Capital One miles are easy to redeem since you can apply them toward a travel purchase on your card or transfer them to one of Capital One’s 15-plus transfer partners. Your pet’s annual vaccines and monthly grooming appointments can now help fund your next trip.

To learn more, check out our full review of the Venture Rewards card.

Apply here: Capital One Venture Rewards Credit Card

Chase Freedom Unlimited

The Chase Freedom Unlimited® is a great choice if you want solid rewards on everyday spending plus bonus cash back in specific categories.

Welcome bonus: Earn an additional 1.5% cash back on everything you buy (on up to $20,000 spent in the first year), worth up to $300 cash back.

Annual fee: $0

Why we like it: The Freedom Unlimited earns 5% back on purchases through Chase Travel℠, 3% on dining and drugstore purchases and 1.5% on all other purchases.

This earning structure alone makes it superior to cards that would only earn 1 point per dollar or 1% back on your pet purchases, but it really shines if you also have the Chase Sapphire Preferred or Chase Sapphire Reserve®. If you do, you can transfer your rewards to that account and redeem them for the full range of Chase’s travel partners.

To learn more, check out our full review of the Freedom Unlimited.

Apply here: Chase Freedom Unlimited

Citi Double Cash

The Citi Double Cash® Card (see rates and fees) has a simple earnings structure, making it great for anyone who doesn’t want to keep track of multiple categories.

Welcome bonus: Earn $200 cash back after spending $1,500 on purchases in the first six months of account opening.

Annual fee: $0

Why we like it: The Double Cash earns 2% cash back on all purchases (1% when you buy and 1% as you pay), so you’ll earn a solid cash return on all your pet spending without worrying about where you’re shopping.

To learn more, check out our full review of the Citi Double Cash.

Apply here: Citi Double Cash

Other ways to save on pet expenses

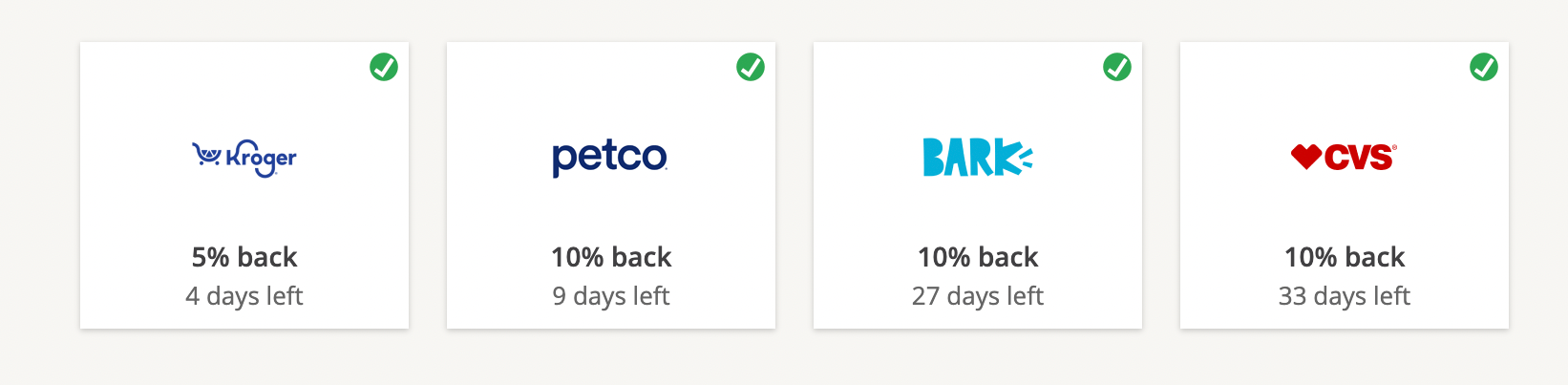

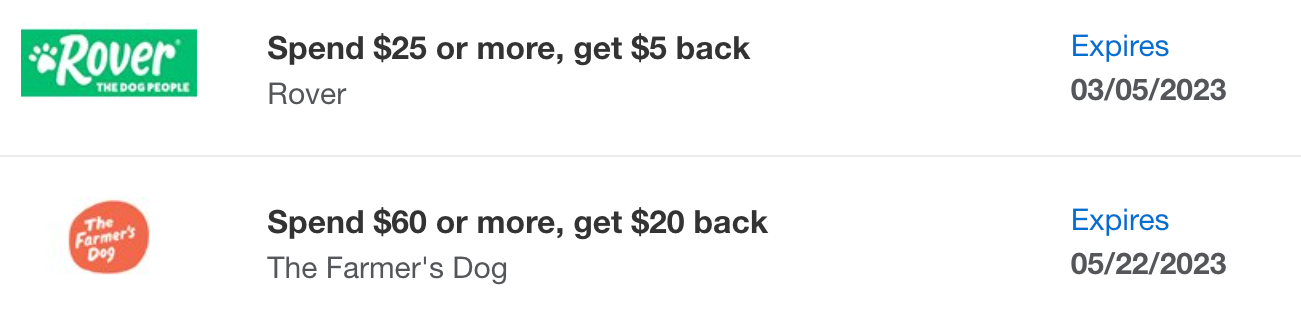

Merchant offers

Chase and American Express regularly have merchant offers that help you save on your pet purchases. Check the offers on all your cards regularly and add any that you think you might use. Then, use the card with the offer and shop at the places that earn money back before the offer expires.

We recommend using a note on your phone to keep track of which offers are on which cards so you can easily reference it when you’re ready to make a purchase.

Gift cards

If you have a credit card that earns bonus points for shopping at grocery or office supply stores, look at the gift cards available at the stores around you.

You can purchase gift cards for pet stores or places like Target or Amazon, use them to shop for your pet’s necessities and earn bonus points on those purchases.

Shopping portals

Always check your favorite shopping portal for stores where you can buy your pet items to earn even more points on your purchases.

Sites like Rakuten can provide additional cash back through their shopping portal at hundreds of popular online retailers. It’s worth checking these sites regularly since their offers can stack with your credit card’s merchant offers and any category rewards you’re earning.

Bottom line

Whether you’re boarding your pet while you go on vacation or just stocking up on essentials, make sure you’re using one of the best credit cards for pet expenses. Our favorite strategies will ensure you get the most points or cash back on everything that keeps your four-legged friend living their best life.

Related: The best rewards credit cards for each bonus category