Southwest Rapid Rewards Plus Credit Card review: Full details

Southwest Rapid Rewards Plus Credit Card overview

The Southwest Rapid Rewards® Plus Credit Card has the lowest annual fee of any Southwest credit card on the market, which is either a strength or a weakness, depending on how you look at it. While the $69 annual fee is affordable, the Plus card lacks the perks offered by its higher-priced counterparts to keep you interested past the initial welcome bonus. Card rating*: ⭐⭐⭐

* Card rating is based on the opinion of TPG’s editors and is not influenced by the card issuer.

In a hobby that feels dominated by ultra-premium credit cards with $550-plus annual fees and laundry lists of luxury perks, it’s hard to imagine that a cobranded airline credit card with a $69 annual fee might be valuable to loyal Southwest customers.

However, the Southwest Plus card does make sense for some flyers — in some cases.

Southwest is no stranger to doing things differently, including offering three affordable personal credit cards. Before you apply, note that this card has a recommended credit score of 670 or above.

Let’s look at how the Southwest Plus card and its perks measure up against its higher-end siblings.

Related: How to choose an airline credit card

Southwest Rapid Rewards Plus pros and cons

| Pros | Cons |

|---|---|

|

|

Related: Credit cards 101: The beginner’s guide

Southwest Rapid Rewards Plus welcome offer

New applicants for the Southwest Plus card can earn 85,000 bonus points after spending $3,000 on purchases within the first three months of account opening. TPG values this welcome offer at $1,105, meaning you’re getting incredible value here. This offer ends June 26.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

This card usually offers 50,000 bonus points. We sometimes see special promotions of 75,000 points or a chunk of bonus points plus a Companion Pass, so picking up 85,000 points makes now a fantastic time to apply.

Before you rush to apply for this card, there are two application rules to remember. First, the Southwest Plus card is subject to Chase’s 5/24 rule. If you’ve opened five or more new credit card accounts (from any bank, not just Chase) in the past 24 months, you likely won’t be approved for this card.

Another limitation applies specifically to Southwest credit cards. If you have any personal Southwest credit card — or earned a sign-up bonus on a personal Southwest card in the last 24 months — you won’t be eligible for the bonus on this card.

Related: The ultimate guide to credit card application restrictions

Southwest Rapid Rewards Plus benefits

There are perks on the Southwest Plus card that go beyond the points from the sign-up bonus. You’ll enjoy the following ongoing benefits in exchange for the card’s $69 annual fee:

- Reimbursement for up to two EarlyBird check-ins every card anniversary; keep in mind that the pricing for EarlyBird check-ins has increased

- 10,000 Companion Pass qualifying points boost every calendar year

- 3,000 bonus points each account anniversary year, worth $39 according to TPG’s valuations

- 25% back on inflight purchases of drinks and Wi-Fi on Southwest Airlines flights

Related: Why I choose Southwest every time

Earning points on the Southwest Rapid Rewards Plus

With the Southwest Plus card, you’ll earn 2 points per dollar on Southwest purchases and with Rapid Rewards hotel and rental car partners. This is a 2.6% return on spending based on TPG’s valuations.

You’ll also earn 2 points per dollar on local transit and commuting (including ride-hailing apps), 2 points per dollar on internet, cable and phone services, 2 points per dollar on select streaming services and 1 point per dollar on other purchases.

It’s worth pointing out that purchases outside the U.S. will still earn bonus points at these same rates, but you will pay a foreign transaction fee of 3%. Thus, this isn’t a good card for purchases in other countries. Plus, other Southwest personal cards earn more points on Southwest purchases.

Related: Are airline credit cards worth it anymore?

Redeeming points on the Southwest Rapid Rewards Plus

Redeem the Rapid Rewards points you earn on the Southwest Plus card for Southwest flights to get the best value from them. Rapid Rewards also offers low-value redemption options, including gift cards, merchandise, hotel stays, rental cars and travel experiences. However, the redemption values on these options are much lower than what you’ll get when using your points for Southwest flights.

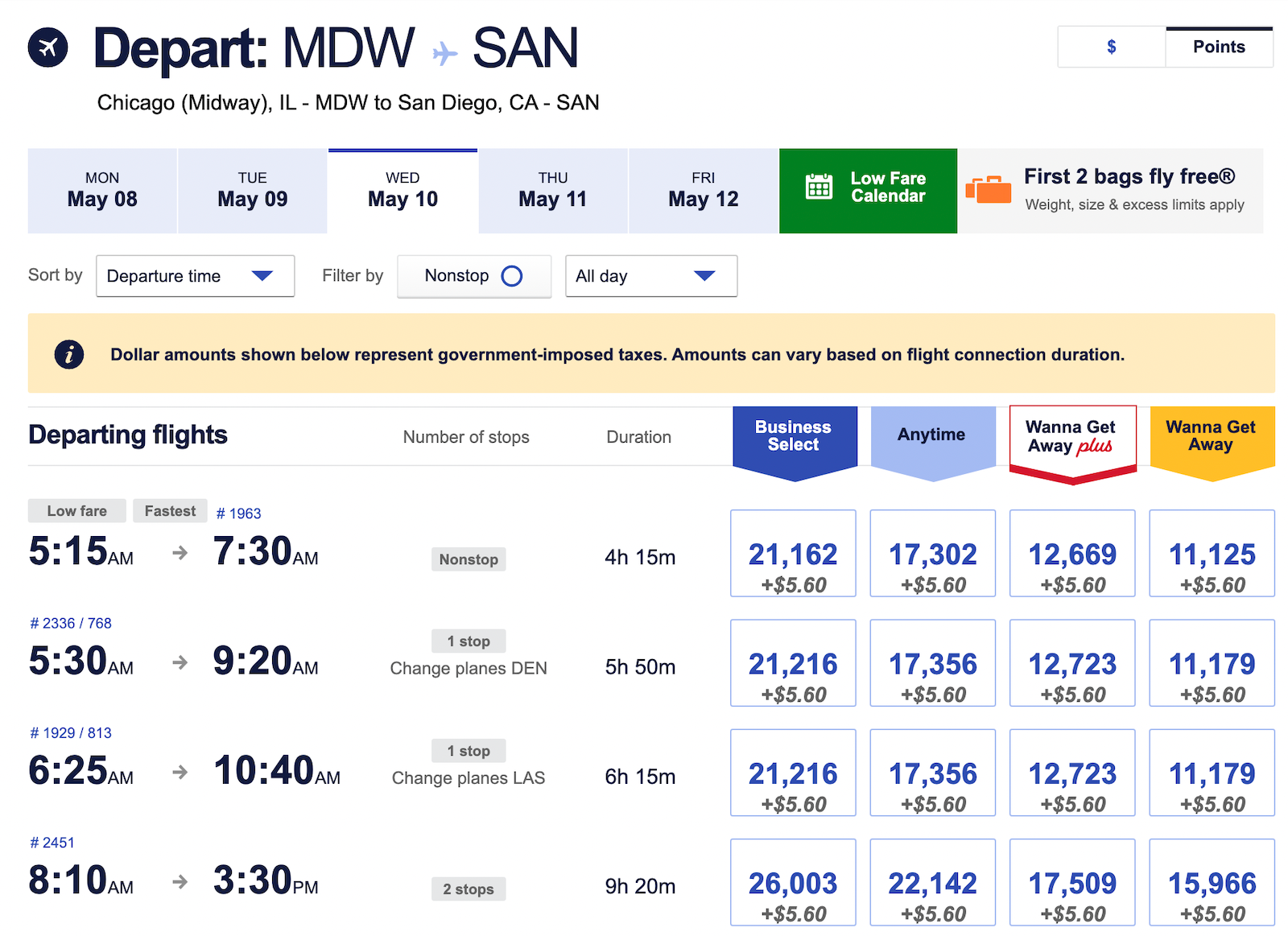

The airline offers four tiers of fares, ranging from the cheapest Wanna Get Away tickets to the more expensive Business Select option — with Wanna Get Away Plus and Anytime fares in between.

Award pricing is tied to the cash price of the tickets. Thus, the number of points you need will go up or down depending on the cash price of the flight. The positive is that using your points for Southwest flights is almost always possible.

TPG director of content Summer Hull redeemed 11,000 Rapid Rewards points to travel from Houston all the way to Lihue in Hawaii. Securing redemptions like these can make your points go even further.

Related: How to redeem points with the Southwest Rapid Rewards program

Which cards compete with the Southwest Rapid Rewards Plus?

The Southwest Plus card’s most obvious competitors are the other Southwest credit cards. However, it’s also worth considering whether a general travel credit card might fit better in your wallet.

- If you want more Southwest benefits with a modest fee: The Southwest Rapid Rewards® Premier Credit Card has solid perks to justify its $99 annual fee. These include 6,000-anniversary bonus points, two EarlyBird check-ins per year, 25% back on inflight purchases and tier-qualifying points toward A-List status. To learn more, read our full review of the Southwest Premier card.

- If you fly Southwest regularly and want the most perks: The Southwest Rapid Rewards® Priority Credit Card is the premium Southwest credit card, offering 7,500-anniversary bonus points and a $75 Southwest travel credit each year. The card has a $149 annual fee. To learn more, read our full review of the Southwest Priority card.

- If you want more points that can be used with Southwest and in other ways: The Chase Sapphire Preferred® Card is a good choice for earning Chase Ultimate Rewards points, which you can redeem with Southwest and other airline and hotel partners. You’ll also get numerous travel protections, and the card has a $95 annual fee. To learn more, read our full review of the Sapphire Preferred.

The information for the Southwest Rapid Rewards Premier credit card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

For more options, check out our full list of the best travel credit cards and best Chase credit cards.

Related: Comparing the Southwest Rapid Rewards Priority, Premier and Plus credit cards

Is the Southwest Rapid Rewards Plus worth it?

The Southwest Plus card has the lowest annual fee of the Southwest credit cards at $69 per year, so it’s a good option for those keeping annual fee costs low or just trying out Southwest. However, if you’re a loyal Southwest flyer, one of the other two personal cards will represent better value.

Bottom line

For only $69 per year, the Southwest Plus card allows you to earn enough points to make it well worth the annual fee. Plus, it comes with a handful of benefits that can justify keeping the card in your wallet every year.

However, if you fly with Southwest often, one of the other two Southwest cards will provide additional perks. Be sure to evaluate what’s best for you beyond simply looking at the annual fee.

Apply here: Southwest Rapid Rewards Plus Credit Card