Quick Points: Save cash and earn bonus points on utilities and insurance

Bills, bills, bills.

If you are forced to pay for Wi-Fi, electricity and/or insurance, those unavoidable monthly expenses can certainly add up. Plus, moving or switching utility providers can add an additional charge to the ever-growing list of inevitable payments.

If you choose to pay bills with your credit card, you’ll find that many of these charges fall outside of typical bonus categories on most cards. So, if you’re into maximizing your spending and saving where you can, you may think you’re out of luck.

Thankfully, that isn’t always the case. With eligible credit cards, you could leverage targeted offers via American Express or Chase to save money on utility bills. Or, if you hold the Bilt Mastercard® (see rates and fees), you could double your points on certain payments if you pay on Bilt Rent Day. Know, though, that Bilt Mastercard cardholders must use the card five times each statement period to earn points (see rewards and benefits).

With all of this in mind, here’s how I’m saving on my utility bills each month.

Earn bonus points and get cash back on utility bills

I’m currently in the middle of a move, so it’s important for me to save anywhere I can while stacking up points.

I’ve been utilizing offers from my American Express® Gold Card and my Chase Sapphire Preferred® Card, as well as making the most of Rent Day in the Bilt Rewards program.

However, since many of these offers are targeted, you’ll have to personally check your accounts to see if you’re eligible for the deals I’ve redeemed. You also have to activate these offers before you redeem them.

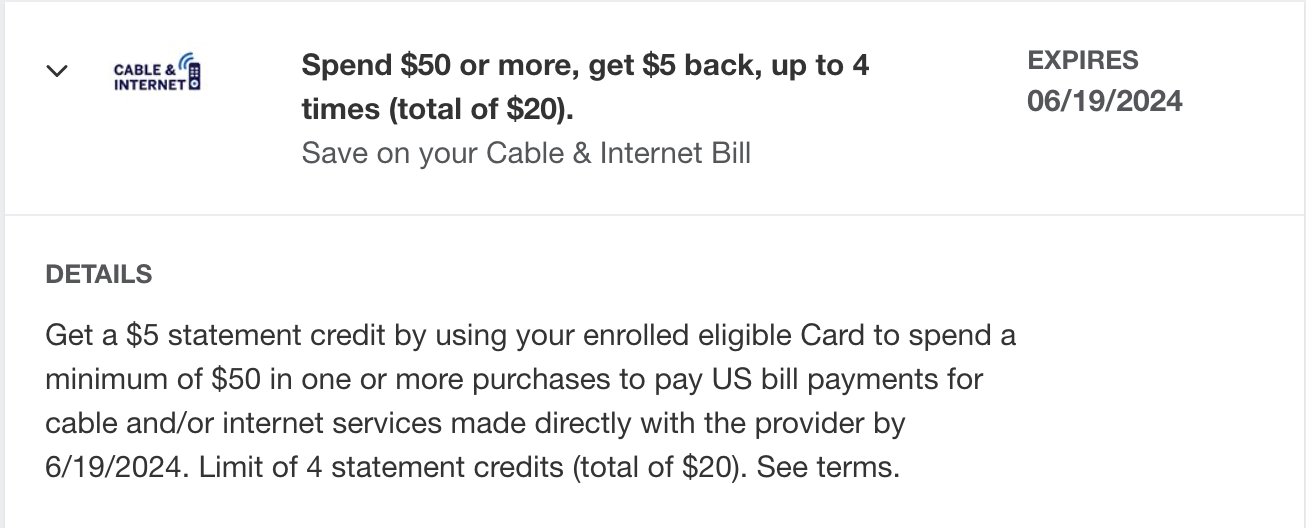

I utilized three Amex Offers that helped me save on two recent bills. I activated an offer to get $5 back after spending $50 or more on cable or internet bill payments made directly with the provider using my Amex card.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

I found the statement credit was applied to my account a few days after I made a $55 AT&T Fiber payment using my Amex Gold; I plan to use this offer for the next two months before my move is finalized in July.

I also used two Amex Offers to make my first renters insurance payment. I was targeted for two separate offers to get 10% and 5% back on insurance bills.

1 of 2

AMERICANEXPRESS.COM

My first renters insurance bill was $48.34. Since I activated both offers before I made the payment, it returned $7.25 total across two statement credits.

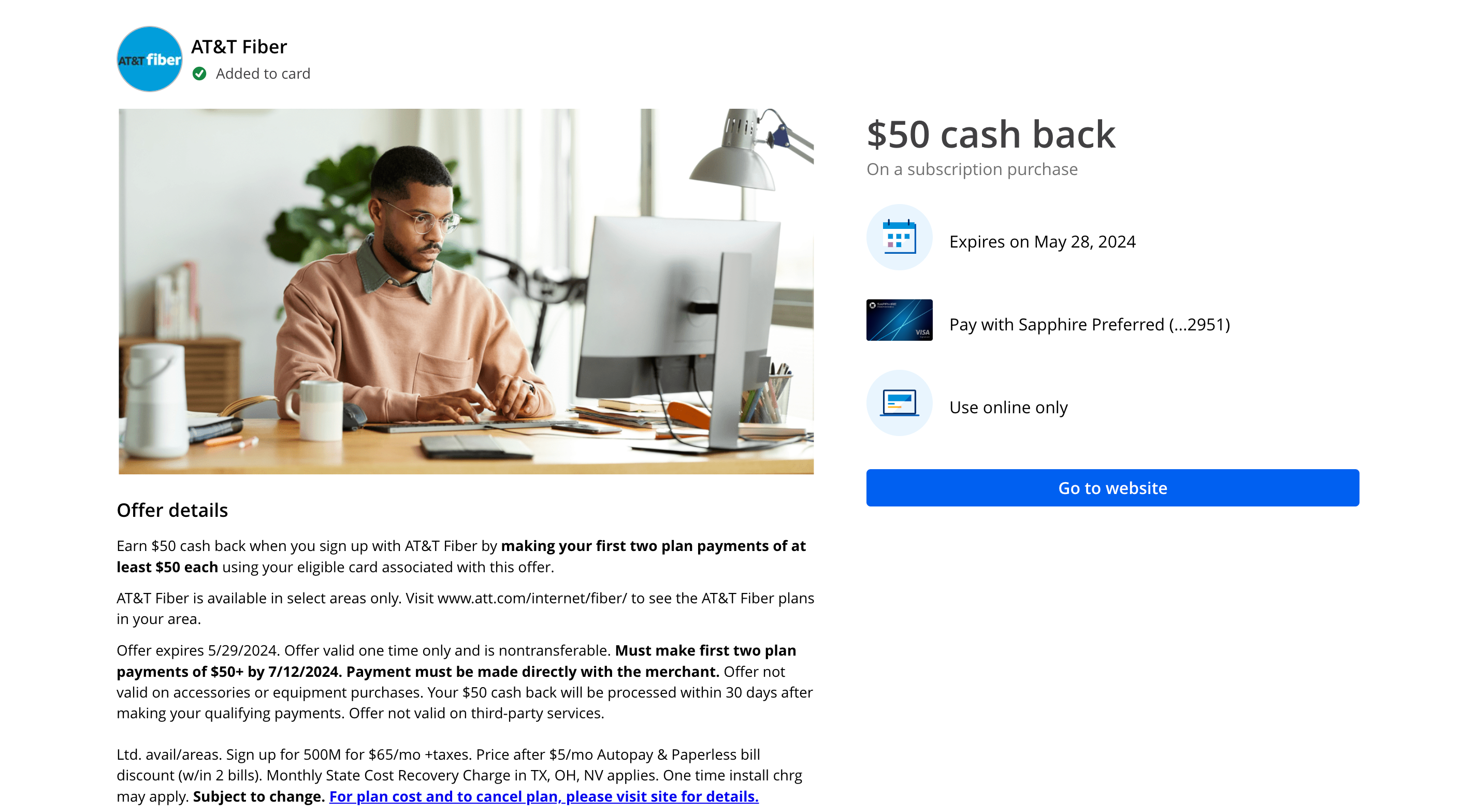

Additionally, I plan to activate a new AT&T Fiber account for Wi-Fi when I move into a new place. My plan of action: I have a Chase credit card that will help me save with this purchase.

Thanks to a Chase Offer I’ve activated, I plan to pay with my Sapphire Preferred to receive $50 cash back on a subscription purchase.

Finally, since I don’t have any cash-back offers or credit cards with bonus earnings on electricity, I use my Bilt Mastercard on Rent Day to pay my power bill.

Every purchase made on the first of the month with my Bilt Mastercard earns double Bilt Points, so I earned 118 points on my most recent $59.85 bill. Bilt points transfer to multiple loyalty programs, including World of Hyatt and Alaska Airlines Mileage Plan.

Even though it was technically posted May 2, I still received double points a little over a week later since I made the payment May 1.

Related: I pay less than $4 a month for 4 streaming services — thanks to this 1 card in my wallet

Bottom line

Don’t assume you can’t earn cash back or bonus points on monthly bills. Activating these offers requires some extra steps, but the rewards will be worth it.

Whether you’re stacking up savings or looking to get points for a redemption, check your credit card offers to see if you’re eligible for these deals. Remember, too, to leverage Rent Day benefits if you hold a Bilt Mastercard.

Finally, always make a point of activating any credit card offer before you redeem it.

See Bilt Mastercard rates and fees here.

See Bilt Mastercard rewards and benefits here.