My Chase Plan and My Chase Loan: The Ultimate guide

The golden rule of credit cards and earning rewards is that we should strive to pay our balances in full each month. The massive interest rates banks charge — especially on travel rewards cards — will quickly strip away any value you may earn from points and miles. Sometimes unexpected expenses can occur, or you cannot pay off your balance due to financial emergencies or poor planning.

Chase offers two financing options for credit card charges: My Chase Plan and My Chase Loan. Each comes with its own fees or interest charges that are usually lower than your regular annual percentage rate (APR) and can help cardholders pay off larger purchases over several months.

Today, we’ll go into the details of My Chase Plan and My Chase Loan to help you better understand what they are and if these financing options are right for you.

My Chase Plan

My Chase Plan is one of two financing options available to most consumer Chase credit cards, such as the Chase Sapphire Reserve® or Chase Freedom Unlimited®.

What is My Chase Plan?

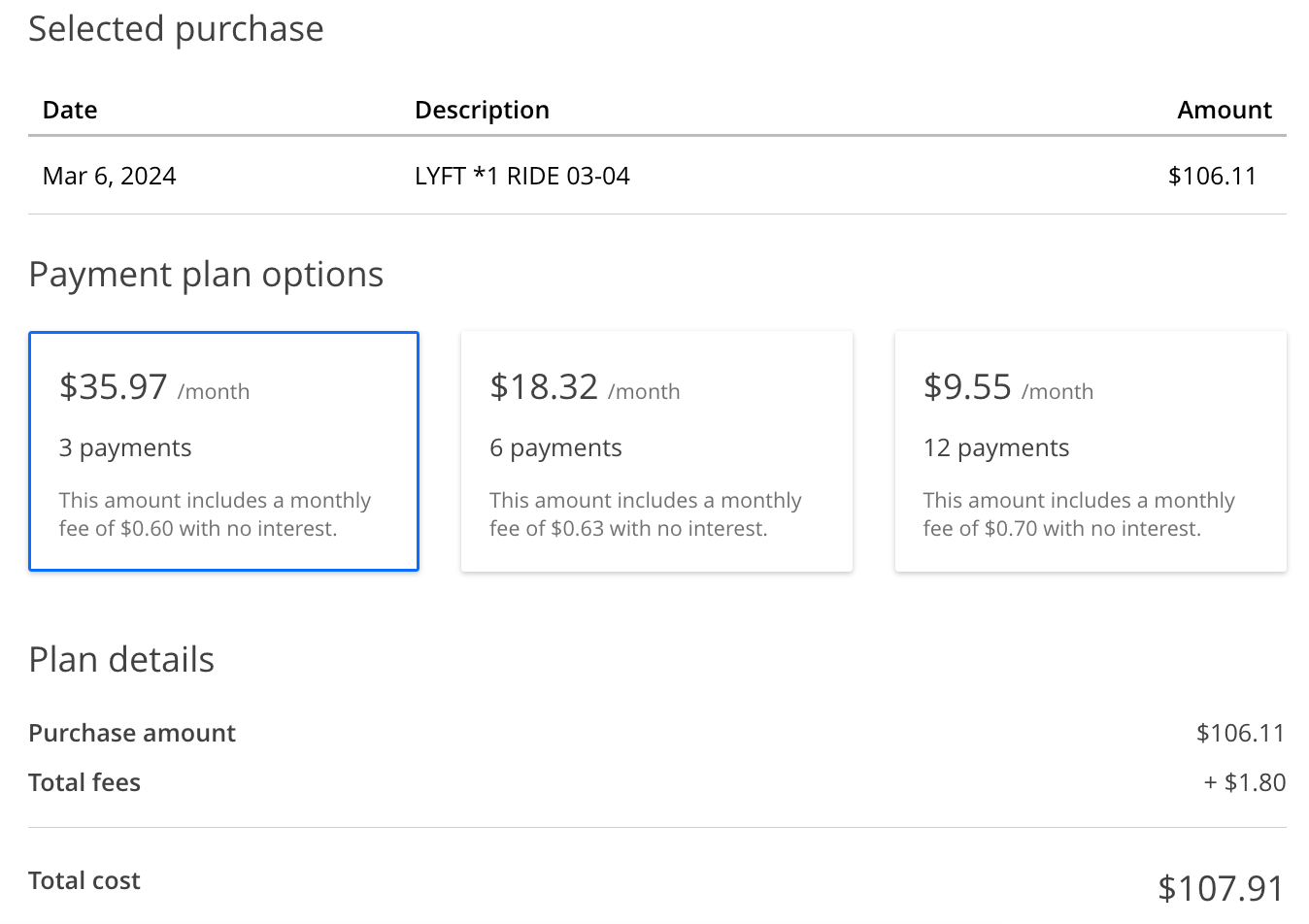

My Chase Plan is similar to the American Express Plan It® feature, where Chase cardholders can repay purchases of $100 or more across a selected number of months with a monthly fee.

The My Chase Plan monthly fee can be up to 1.72% of each eligible transaction. This fee varies based on factors such as the amount being financed and the plan duration for repayment that is chosen but is usually less than any interest charges you would have accrued if you just carried the balance.

Chase cardholders can have up to 10 plans on their account at any time. Sometimes, Chase will offer promotional pricing of $0 monthly fee for My Chase Plan, and this would be the best time to utilize it.

How does My Chase Plan work?

My Chase Plan is a way for cardholders to finance their eligible purchases by utilizing their existing credit card and line of credit without transferring the balance to a balance transfer card. Chase can offer repayment terms anywhere from three to 18 months based on the purchase amount. Cardholders are presented with three repayment term options when selecting a My Chase Plan.

Although you will not be charged interest on the balance you carry monthly, Chase does charge a monthly fee for enrolling a purchase in My Chase Plan and paying it off. The monthly amount of your My Chase Plan is added to your minimum balance, so to ensure you’re paying off your My Chase Plan, cardholders must pay at least the minimum balance of their card each month.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Pros and cons of My Chase Plan

| Pros | Cons |

|---|---|

|

|

My Chase loan

My Chase Loan allows cardholders to borrow money from their existing line of credit from their Chase cards and is a better way to borrow money than a cash advance.

What is My Chase Loan?

My Chase Loan lets you utilize your line of credit by depositing a loan into your checking account without fees and with a relatively low APR. My Chase Loan is an effective way to borrow money from your existing line of credit without the need to apply for a loan from another bank, which would also earn you a hard inquiry on your credit report.

How does My Chase Loan work?

You can set up My Chase Loan online at Chase.com or on the mobile application. The minimum amount you can borrow is $500, and the maximum loan amount is dependent on your creditworthiness and account history. Chase offers loan terms from 12 months to 24 months, and once a plan is selected, the funds are deposited into your account within two business days.

Each month your minimum balance due will be reflective of your My Chase Loan monthly payment and the minimum payment due for purchases made in the previous billing cycle. There’s no penalty for paying off your My Case Loan early.

Related: What is a good APR for a credit card?

Pros and cons of My Chase Loan

| Pros | Cons |

|---|---|

|

|

Does My Chase Plan or My Chase Loan affect my credit score?

To put it simply, yes. Although there is no credit inquiry when utilizing either My Chase Plan or My Chase Loan, you are still using up your line of credit and paying it off over time.

With credit cards, credit utilization and amounts owed are two key factors in determining your credit score. If you have a line of credit of $20,000 and are utilizing $10,000 as a My Chase Loan, then you’re utilizing 50% of that card’s overall line of credit. The same goes for My Chase Plan: even though you aren’t accruing interest, paying a card off slowly still shows the credit bureaus that you have debt month over month.

If you have a My Chase Loan and multiple My Chase Plans activated on your account, your debt owed month to month will be even more, resulting in a drop in your credit score.

Whatever drop in credit score you may experience with either financing play is temporary because as you pay off the debt, your overall credit utilization will decrease, you’ll continue displaying on-time payments and can raise your credit score again.

Related: Is 30% credit card utilization the magic number?

Are My Chase Plan and My Chase Loan worth it?

If you can afford to pay off a purchase on time and in full and thus avoid both interest payments and fees, that option makes the most sense. However, for large purchases where you know you won’t be able to pay off the balance in full, My Chase Plan and My Chase Loan can be a lower-cost option than carrying a balance and accruing interest on your purchase.

It’s even more worth it to utilize My Chase Plan if you’ve been targeted for a no-fee offer. In this case, you’ll have more time to pay off your purchase without being charged a fee. The only drawback in this scenario is that your credit utilization may increase when you’re paying off your My Chase Plan.

Another option to choose if you want to avoid interest and fees is a 0% APR credit card. Many top cash-back credit cards offer an introductory period from 12 to 18 months, where you can pay off new purchases with a 0% APR (though a variable APR will apply to your balance once that introductory period is over). For those really large purchases, a 0% APR card might be the better way to go if you want to use credit cards to finance.

Related: Pros and cons of zero percent APR credit cards

Bottom line

Financing options such as My Chase Plan and My Chase Loan can be a decent choice in a pinch because they allow you to pay for your purchases over time without accruing interest. Still, work to avoid needing them as much as possible. Borrow responsibly and pay off your debt within the allocated time to avoid penalties and damage to your credit score.

Further reading: