How to redeem Citi ThankYou points for maximum value

Update: Some offers mentioned below are no longer available. View the current offers here.

Citi is a TPG advertising partner.

The Citi ThankYou Rewards program remains one of the best for credit card users looking for flexible cash-back options or travel rewards. The program currently has several airline transfer partners and some of those partner programs offer the best use of ThankYou points.

Citi currently offers five cards that allow you to earn ThankYou points:

- AT&T Access Card from Citi.

- Citi® Double Cash Card.

- Citi Premier® Card.

- Citi Rewards+® Card.

- Citi Rewards+℠ Student Card.

- Citi Custom Cash℠ Card.

Even though the Custom Cash card is branded as a cash-back card, you’ll earn rewards in the form of Citi ThankYou points. If you already carry one of Citi’s travel rewards cards (such as the Citi Prestige® Card or the Citi Premier Card), you can combine the points earned on that card with the points earned on the Custom Cash.

Additionally, there are cards that are not open to new applicants, but existing members can continue earning and redeeming points:

- Citi Prestige Card.

- Citi ThankYou® Preferred Card.

- Citi ThankYou® Preferred Card for College Students.

- AT&T Access More Mastercard from Citi.

The information for the AT&T Access, Rewards+ Student, Citi Prestige, ThankYou Preferred, ThankYou Preferred for College Students and the AT&T Access More cards has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

The ThankYou Rewards program may not be as highly publicized or well regarded as Chase Ultimate Rewards or American Express Membership Rewards. Still, if you know how to leverage your ThankYou points through transfer partners, you can get great value. In this guide, we’ll explore some strategies to make the most of your points.

Want more credit card news and advice from TPG? Sign up for our daily newsletter.

Earning Citi ThankYou points

You can earn ThankYou points from spending on Citi credit cards in the ThankYou portfolio or from targeted account-opening bonuses.

Citi banking customers with Citigold, Citi Priority or Citi Private Bank accounts may also earn additional bonuses through that relationship. As of March 28, 2022, the Double Cash card now earns ThankYou points directly, rather than needing to convert cash-back earnings into points.

The value of your points depends on which ThankYou points-earning credit cards you hold. Premium cards, such as the Citi Prestige and Citi Premier, offer more options to spend your points and more ways to increase their value.

Every card in the ThankYou Rewards family allows you to redeem points toward the cost of airfare, hotels, cruises, gift cards, cash or loan payments at a redemption value of 1 cent per point. You can also request a statement credit or pay with points when shopping, but these are not the best ways to spend your rewards because you aren’t maximizing the points value.

Related: The ultimate guide to Citi ThankYou rewards

Unfortunately, the options available to you and what value you will obtain from your points will vary depending on which ThankYou points-earning card(s) you hold. If you only hold a card with no annual fee, you may have access to limited transfer partners and some reduced transfer rates — this applies to the Double Cash, Rewards+ and Rewards+ Student cards — or no ability to transfer to partners at all. This applies to the AT&T cards and the Custom Cash.

If you hold the Premier or Prestige card, this will open all of the transfer partners to you, as well as the improved transfer rates, and you can do so with the points earned across all of your cards. This is because you can combine your cash-back earnings and ThankYou points in the account associated with your higher-tier card. Then you can use your combined points with one of the several transfer partners to squeeze the most value from your points.

Citi Premier

The Citi Premier, the second-tier ThankYou points-earning card, is currently offering 60,000 points after you spend $4,000 on purchases in the first three months of account opening. The Premier card earns 3 points per dollar spent on hotels, air travel, restaurants, gas stations and supermarkets and 1 point on all other spending. Plus, for a limited time, earn 10x points per dollar on hotels, car rentals, and attractions (excluding air travel) booked on the Citi Travel℠ Portal through June 30, 2024. The earning structure is one of the big reasons to get the Citi Premier. The card has a $95 annual fee.

While it no longer offers many purchase protection and insurance benefits, the sign-up bonus, relatively low annual fee and high earning capabilities still make this card worthwhile for earning and redeeming points.

Citi sign-up bonus restrictions

Before you apply for the Premier card, you’ll want to make sure you qualify for the sign-up bonus. You are not eligible if you have received one for other Citi ThankYou rewards cards or closed a Citi ThankYou card account in the past 24 months.

With the earning side of ThankYou points explained, let’s look at the redemption options you should avoid and those that will give you maximum value.

Related: Best ways to redeem Citi ThankYou points on SkyTeam airlines

Best ways to redeem Citi ThankYou points

Avianca LifeMiles

Colombian airline Avianca has a loyalty program called LifeMiles, one of the most undervalued airline loyalty programs. Citi has been offering transfers to LifeMiles since 2017 — long before American Express and Capital One began partnering with Avianca — and routinely offers transfer bonuses.

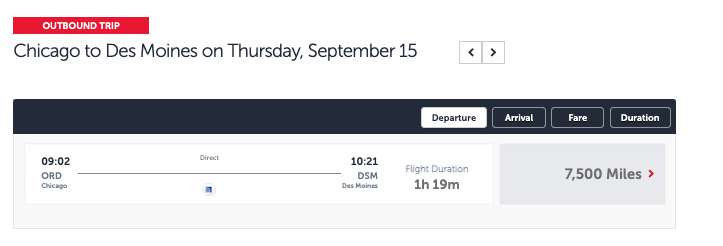

There are many routes worth investigating, but you’ll find the best value on domestic short-haul flights on Star Alliance partner United. These currently start at just 7,500 miles each way, but certain city pairs dropped to 6,500 miles in summer 2019. We’ve even seen some fall to as low as 3,500 miles.

You can also book Lufthansa first class to Europe for 87,000 miles one-way with no fuel surcharges. The Star Alliance partner award chart is full of reasonably priced award routings, and you can routinely buy LifeMiles at a reasonable price compared to the value these redemptions offer. You can even score lower rates on mixed-cabin awards.

Related: 6 tips for booking Lufthansa first-class awards

The more time you spend on the LifeMiles award-booking engine, the more familiar you become with some of the nuances and great value the program offers. If you are not familiar with this Citi transfer partner, create an account and search a few of your upcoming routes to see what value the program could provide to you.

Singapore KrisFlyer

Singapore Suites and Singapore first class continue to be among the top products in the sky, and they’re generally only bookable via Singapore Airlines’ own KrisFlyer program. The airline doesn’t release long-haul premium-cabin award space to its partners. Prices are relatively reasonable for Singapore’s first-class routes serving the U.S., including from New York’s John F. Kennedy International Airport (JFK) to Frankfurt Airport (FRA) for 86,000 miles in Suites class and from Los Angeles International Airport (LAX) to Tokyo’s Narita International Airport (NRT) for 107,000 miles in first class. Even if your desired routing or class of service isn’t open at the time of booking, you can easily waitlist for a better award.

Singapore KrisFlyer also has a few sweet spots for booking Star Alliance routes, including 35,000 miles in economy or 69,000 miles in business for a round-trip award from the U.S. mainland to Hawaii on United. By transferring to this program, you can use ThankYou points to fly United to Hawaii for fewer miles than United’s own program charges.

Etihad Guest

The Etihad Guest program continues to fly under the radar but represents a tremendous value when you use ThankYou points. You can fly almost anywhere in the world for incredibly reasonable prices using only Etihad Guest miles and the airline’s wide array of partner programs. This includes routes and airlines you didn’t know existed, such as Royal Air Maroc’s Dreamliner service to Africa from JFK to Casablanca’s Mohammed V International Airport (CMN) for only 44,000 miles in business each way.

Most applicable to us here in the U.S. is the ability to book awards on Etihad partner American at pre-AAdvantage devaluation prices. American increased the rates of its own award tickets, but Etihad has not updated the Etihad Guest American award chart (warning: PDF link). You can still fly American business class one-way to Europe, Japan or South Korea by transferring 50,000 ThankYou points to Etihad.

Virgin Atlantic Flying Club

Using points for flights on Virgin Atlantic’s own metal rarely results in a good value due to the high surcharges, taxes and fees you’ll have to pay, but the Flying Club program does have a variety of partner awards you can book. Air New Zealand and Delta routinely produce incredible redemption opportunities for long-haul business-class flights with relatively small amounts of miles, such as 50,000 Virgin Atlantic miles for the Delta One suite between the U.S. and Europe (excluding the United Kingdom) or 62,500 miles for Air New Zealand business-class one-way from Auckland, New Zealand, to the U.S.

Of course, you can’t overlook the ability to book ANA first class from the U.S. to Tokyo for 110,000-120,000 miles round-trip, depending on where in the States you depart from. That’s less than most airlines would charge for a one-way ticket, and it gives you a chance to fly on one of the world’s most refined airlines.

Related: The new gold standard: Review of The Room, ANA’s new business class on the Boeing 777-300ER

Turkish Airlines Miles&Smiles

While we are including this in the “best” section because of the value the Miles&Smiles program can provide, it doesn’t come without some caveats.

The program offers numerous sweet spots when flying on Star Alliance partners, including transcontinental business-class seats for just 12,500 miles each way and economy flights to Hawaii for 15,000 miles round-trip. Likewise, you can book any U.S. domestic route for just 7,500 miles. Yes, those are real prices.

Unfortunately, booking the flights is not without some quirks. The largest of these is the fact the Miles&Smiles website is unreliable regarding what award availability it will show. You may need to call or email to complete bookings after first verifying availability with your favorite way to search for Star Alliance flights.

You should also know that transfer times from Citi to Turkish Airlines are a day on average, and you cannot put partner awards on hold. Thus, the program can provide extreme value in terms of what you can book, but the seats might disappear while waiting for your points to transfer if you’re trying to grab the last seat available.

Related: Everything you need to know about United Polaris business class

Middle-of-the-road redemptions

Cathay Pacific Asia Miles

Cathay Pacific’s Asia Miles program has some interesting redemption opportunities, thanks to how it defines regions and routing rules. But it’s difficult to decipher the complex rules to book a ticket. If not for the complicated process, I’d rank it as a maximum-value redemption.

Program changes in June 2018 also increased the cost of premium-cabin redemptions and made the online booking engine less useful. Another strike against the program: There’s still no award chart for itineraries consisting of only a single partner airline. Plus, you cannot book American Airlines awards online; you must call to book these flights.

Nevertheless, you can find some decent values. For instance, you can book round-trip business class to Europe for 100,000 miles. Likewise, a one-way to Europe with a stopover is only 50,000 miles.

Dozens of gems are waiting to be discovered in the program’s complex rules, which even phone agents don’t always know. If you’re willing to put in the effort, this could be a maximum-value redemption. Because so few take advantage, though, I’ll keep it in the decent-value category.

Air France-KLM Flying Blue

There are several fantastic uses of the Air France-KLM loyalty program, though they’re sometimes difficult to find. With the program’s dynamic pricing model, you can’t be sure what Flying Blue award tickets will cost until you actually search. That makes it hard to proactively set a mileage goal and then work to meet it. However, you can get some decent value from the program’s Promo Rewards, which rotate regularly and typically offer 25%-50% off economy- or business-class awards from specific North American gateways to Europe and beyond.

The program also allows you to visit far-flung places such as Papua New Guinea on partner Aircalin, and you can use creative routings to lower the price of your ticket or potentially add additional segments at no extra charge. However, fuel surcharges can be a real headache with the program, and they increase for premium-cabin redemptions.

Flying Blue isn’t the program it once was, but if you catch a Promo Reward or find award space on a Delta-operated route (you may need to call for domestic flights), the program can yield good value.

Related: Best ways to redeem Citi ThankYou points on Oneworld airlines

How not to redeem your Citi ThankYou points

Statement credits and Shop with Points

Although Citi has made it easier to redeem rewards in real-time, using ThankYou points for statement credit or the Shop with Points program isn’t a great idea.

These will all give you much less than 1 cent per point in value, which is low compared to the redemptions highlighted above. Paying directly with ThankYou points at BestBuy.com will give you less than 1 cent per point, compared to redeeming points for 1 cent each for Best Buy gift cards. Additionally, statement credit options to erase purchases from your credit card bill offer 0.8 cents per point in value, which is not strong compared to the options discussed above.

A handful of airline transfer partners

All Citi airline transfers allow you to transfer miles at a 1:1 ratio when holding the Prestige or Premier card. However, the value of those miles varies greatly, as does flight availability, ease of booking, fuel surcharges and other fees that can drive up the cost of your ticket. Redemptions with EVA Air and Thai Airways give you a poor return.

You should avoid transferring to these partners except in unique and specific circumstances. There are several reasons for this, including the number of miles required, high fuel surcharges and a lengthy (read: frustrating) booking process. It could be worth checking out these partners in specific instances, but make sure you evaluate other options as well.

Citi ThankYou Travel Center redemptions

Cardholders could redeem points at a flat rate of 1 cent each toward airfare through the Citi ThankYou Travel Center. This means that you most certainly have better options by transferring your points to one of Citi’s travel partners.

No doubt, it’s easy and convenient to book through the Citi Travel Center, as you can book nearly any seat on any flight and earn redeemable and elite qualifying miles if you’re a member of that airline’s frequent flyer program. Unless the cash price is so low that paying with your points is cheaper than transferring them, you’re leaving money on the table using your points this way.

Related: Best ways to redeem Citi ThankYou points on Star Alliance airlines

Reconsidering cashing out points

With the transfer partners highlighted as good options above, you can regularly achieve TPG’s average valuation of ThankYou points, which is 1.7 cents per point. It’s also quite probable that you will achieve a higher value on your points redemptions when using the options highlighted above or redeeming for award flights in first class or business class.

We’ve alluded to the fact that you can cash out points at a rate of 1 cent apiece. But it’s actually possible to do better than that, assuming you have the Rewards+ card. That’s because a key feature of the Rewards+ card is that you receive a refund of 10% of your redeemed points each year, on up to 100,000 points redeemed (so 10,000 points refunded).

If you have multiple ThankYou points-earning cards and link them all to the same ThankYou Rewards account, this 10% points rebate will take effect when cashing out points from your Premier or Prestige card. Thus, cashing out 10,000 points at 1 cent apiece would give you $100 in value via bank deposit, but the 10% points rebate adds another 10% in value to this when considering the bigger picture — especially since you would get a further 10% of your points back when redeeming the points from your first rebate, and this will continue until you’ve reached the annual maximum.

Can you still achieve higher value through transfer partners? Yes. However, it’s worth a second look at this unique ability to combine card benefits for increased value when cashing out points.

Bottom line

As with most transferable-point loyalty programs, you’ll almost always get the biggest bang for your buck when you transfer your Citi ThankYou points to partner programs. Many award travelers often overlook the Citi ThankYou Rewards program or undervalue its points.

Even if you decided to limit your choices to Virgin Atlantic and Etihad Guest and their respective partners, you could reach almost any destination in the world on reasonably priced award tickets. Add in all the other transfer possibilities and the variety of sweet spots in the program, and there’s no such thing as too many ThankYou points.

Additional reporting by Dawn Allcot, Benji Stawski and Ryan Smith.