How to get the Resy credit on the Delta Amex cards

When I learned the annual fee for my Delta SkyMiles® Reserve American Express Card was increasing a full $100 (from $550 to $650; see rates and fees), I faced a tough decision — was this premium travel card still worth it?

Right now, new cardmembers have an easier time justifying the higher annual fee on the Delta Reserve Amex because of its limited-time welcome offer. New cardmembers can earn 95,000 bonus miles after spending $6,000 on the card in the first six months of card membership (ending July 17). Considering TPG’s July 2024 valuations, that bonus is worth up to $1,093. For existing cardmembers, however, finding value can be tougher.

I decided to keep my Delta Amex Reserve this year to test the value of its new benefits. While I’m still figuring out the best way to take full advantage of each perk, the monthly Resy (an online restaurant reservation service) benefit has been surprisingly simple to earn. So simple, in fact, that I recently earned the statement credit without even realizing it.

Here’s how.

Related: Do you have a Delta Amex card? Here are 9 things you need to do

Delta Amex statement credits

It’s not often that a card makes it this easy to use its perks, but that’s exactly what happened to me last month. Before I explain exactly how this happened, let’s look at the Delta Amex statement credits and who is eligible to receive them.

The full lineup of Delta and Amex cobranded cards received annual fee bumps and altered perks earlier this year. I will only focus on the cards with the same statement credits as my Delta Reserve Amex.

Here’s a closer look at the annual and monthly statement credits:

- Delta Stays (Delta’s hotel travel portal) for prepaid hotels and vacation rentals

- Resy for eligible purchases at Resy restaurants in the U.S.*

- Ride-hailing services like Uber, Lyft, Revel, Curb and Alto*

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

*Enrollment is required for select benefits; terms apply.

The amount that you can receive for these statement credits varies by card. These are the cards that are eligible to receive all three of these statement credits:

If you have one of these four cards, you can use the listed statement credits to offset the annual fee if you know how to use them. TPG has a must-read guide to help you maximize these credits, so I won’t repeat that here. Instead, let’s get back to my surprise credit.

Earning the monthly Resy statement credit

With my Delta Reserve Amex, I get up to $240 annually (up to $20 monthly) in statement credits when I dine at a restaurant that participates in the Resy reservations system and pay with my Delta Reserve Amex. You may be wondering how a perk that involves dining at specific restaurants was able to surprise me, but it did.

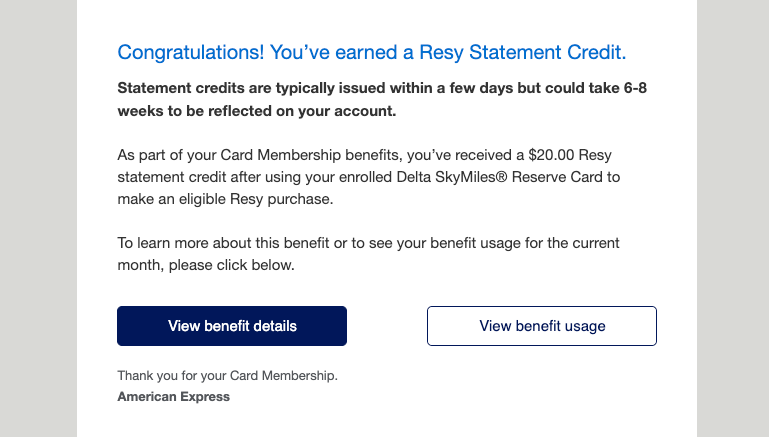

That’s because you don’t have to make a reservation through Resy to earn the credit; you only have to pay your bill using an eligible card. I received an email alerting me that I had earned a $20 Resy statement credit, though I had no recollection of dining at a participating restaurant.

My husband was out of town then, so the only dining out I had been doing was hitting the McDonald’s drive-thru to get Happy Meals for the kids. As much as my kids love a quick and cheap meal from McDonald’s, I knew that couldn’t have triggered the credit. (McDonald’s has an awesome rewards program, though.)

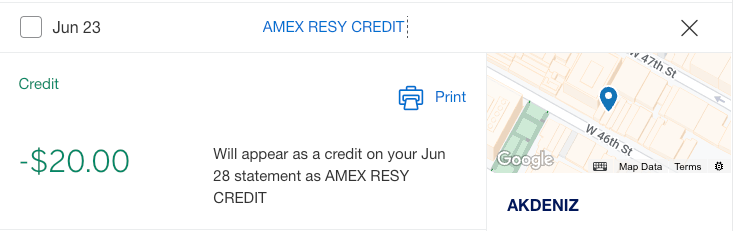

Luckily, Amex makes determining which charge triggered the Resy credit easy. I logged in to my account and found the restaurant’s name was listed in the $20 credit transaction. The surprise meal was one my husband had eaten while he was in New York City. Mystery solved!

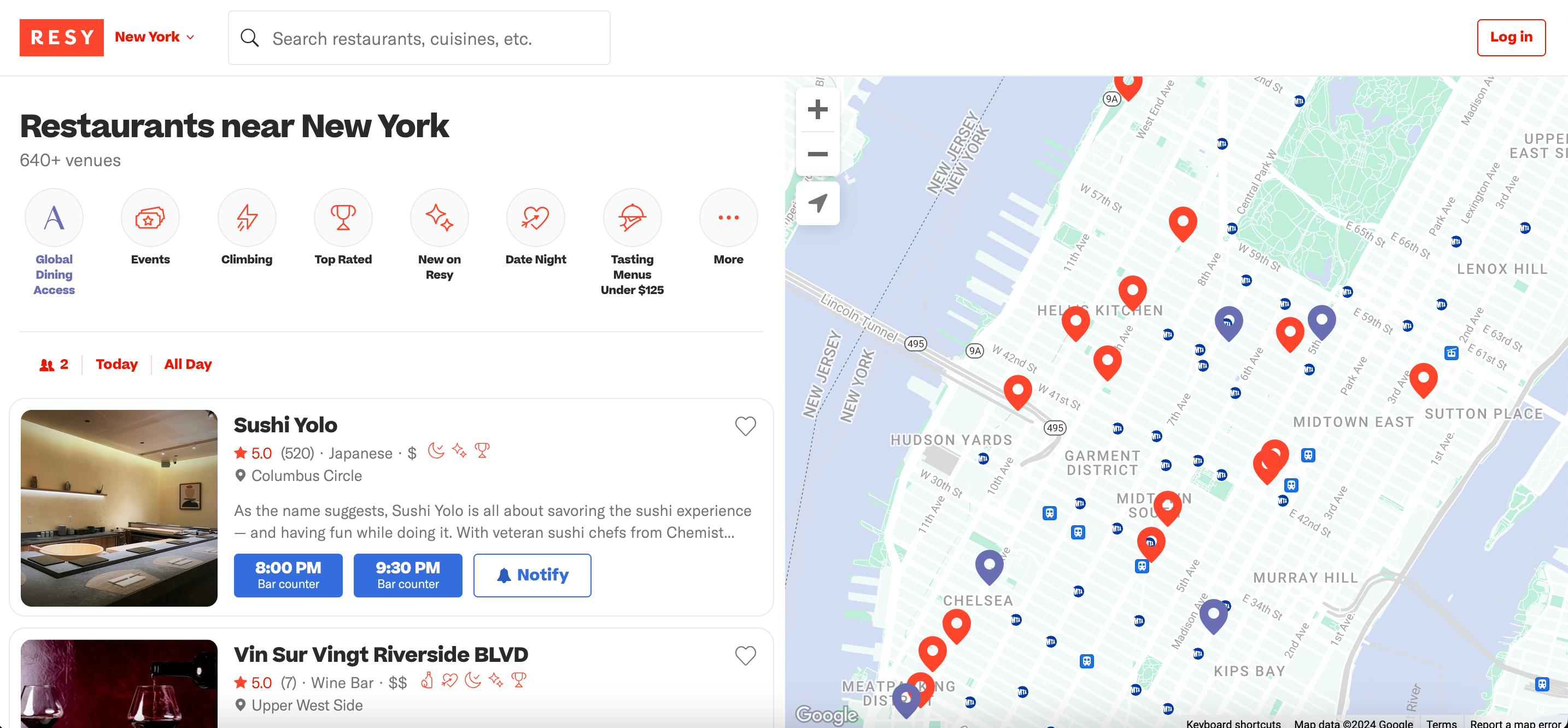

New York has a long list of Resy-affiliated restaurants. If you dine in New York or another metropolitan area, you could also receive a surprise statement credit using your eligible Amex card to pay for your meal.

We don’t have as many participating restaurants in my hometown, so I have to plan more carefully to use my monthly Resy credit. My strategy so far involves reviewing the list of restaurants at the beginning of the month as a reminder to stop by one for dinner or drinks at some point. Or, if I have a trip coming up, I’ll look at restaurants at my destination and add one to the itinerary.

Finding Resy-affiliated restaurants is easy. You can use the Resy website or app to search for nearby restaurants and either make a reservation or visit as a walk-in. Just remember to pay the bill with your eligible Amex card.

Related: Why the Delta SkyMiles Reserve card is the best card I’ve added to my wallet in the past year

Other real-world examples

TPG senior editorial director Nick Ewen also has the Delta Reserve Amex, and he’s been able to use the Resy credit in a few ways. In March, he enjoyed a $20 statement credit at a restaurant on Restaurant Row in New York City, and he also used it to offset part of a recent brunch in South Florida with his family.

He even purchased a physical gift card at a local Resy establishment for a friend’s birthday, triggering the $20 statement credit.

TPG senior director of product management Gabe Travers is usually the reservation maker among his friends, so he has a pretty good mental Rolodex of what’s on Resy — and what’s not.

“Between home and travel, we usually eat at a Resy restaurant at least once a month. It does take a little bit of training to remember to pull out my Delta Reserve Amex, as it isn’t usually where I put my dining spending (that’s usually my American Express® Gold Card) — but the new monthly statement credits help offset the higher Delta Amex annual fees,” he said.

Like Nick, Gabe has also found that he can earn the monthly statement credit by purchasing restaurant gift cards.

“One of my favorite local Resy restaurants that uses Toast as its point-of-sale system also sells gift cards on its website that also process via Toast,” he said. “In my experience, those seem to trigger the statement credit since it’s the same restaurant, same charge — then I can save up for an even nicer night out.”

We’ve seen other anecdotal evidence that a gift card purchase will typically trigger the statement credit, but your mileage may vary based on how the restaurant charges your card.

Bottom line

If I use it every month, the Resy statement credit can be worth up to $240 per year. Combined with up to $120 in annual ride-hailing statement credits and the Delta Stays statement credit worth up to $200, that’s $560 per year in savings, which falls only $90 short of my Delta Reserve Amex’s $650 annual fee. Enrollment required for select benefits.

When I factor in the card’s other benefits, like an annual companion certificate, Delta Sky Club lounge access* and free checked bags, I can easily squeeze $650 in value from this card. If you are considering adding a Delta Amex to your wallet, you can get even more value in the first year when you earn the introductory welcome offer.

*Beginning Feb.1, 2025, access will be limited to 15 visits per year.

To learn more, read our full review of the Delta Reserve Amex.

Apply here: Delta SkyMiles Reserve American Express Card

Related: Is the Delta Reserve Amex worth the annual fee?

For rates and fees of the Delta Reserve Amex, click here.

For rates and fees of the Delta Platinum Amex, click here.

For rates and fees of the Delta Platinum Business Amex, click here.

For rates and fees of the Delta Reserve Business Amex, click here.