Earn points, miles and cash back while doing your taxes

Tax season is quickly approaching. If you’re looking to maximize the points, miles and cash back you earn while doing your taxes, there are a few things you should consider.

For example, if you plan to use software to prepare your taxes, you’ll want to check online shopping portals and credit card merchant offers before settling on a service. And whether you’re preparing your own taxes or hiring a professional, you’ll also need to consider how to pay for the preparation and any resulting taxes you owe. So, let’s dive in.

Check portals and merchant offers

There are many tax software packages on the market that you may want to use to prepare your taxes. During previous tax seasons, we’ve seen excellent offers for select tax software providers through online shopping portals.

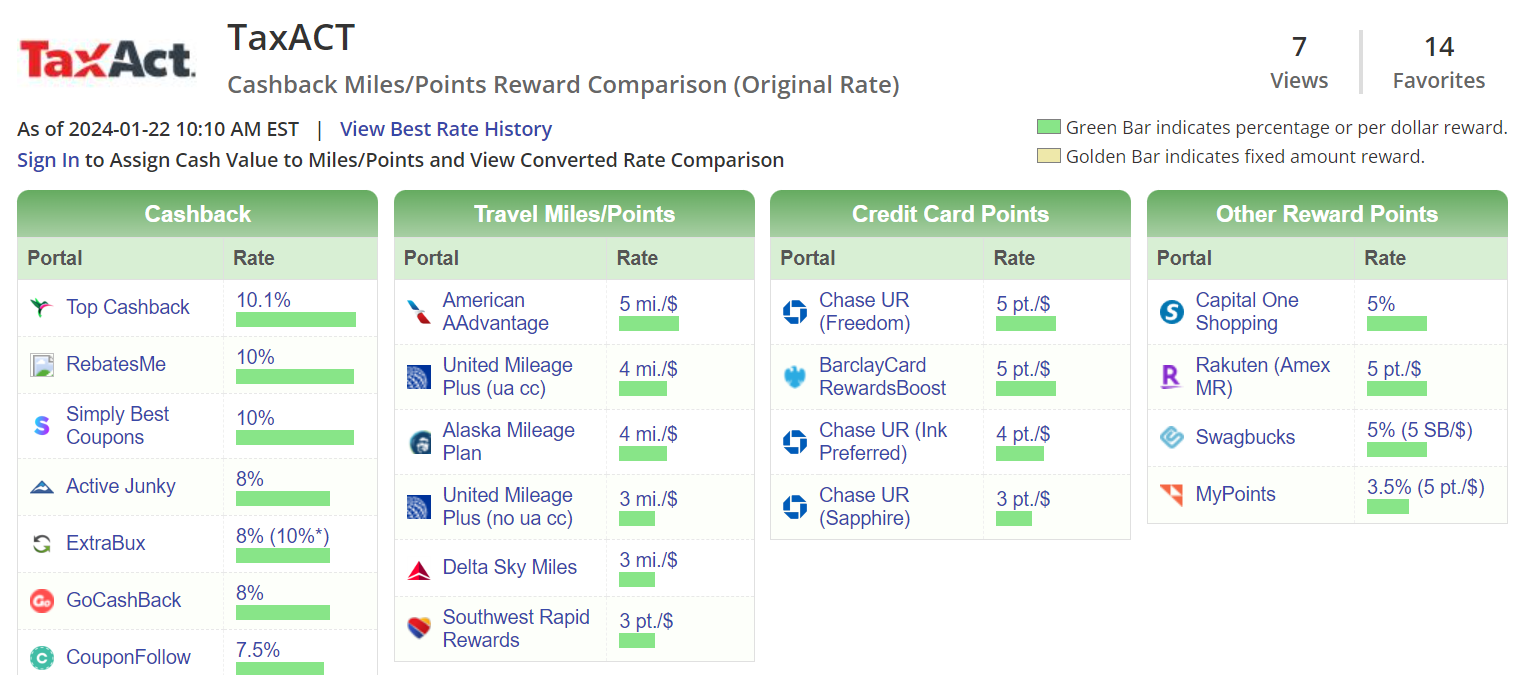

The best offers tend to appear as the April 15 individual income tax filing deadline approaches. But I recommend using a shopping portal aggregator like CashbackMonitor to quickly compare the choices for your preferred software. For example, here are the options at the time of writing for TaxAct:

It’s also worth checking your Amex Offers, Citi Merchant Offers, Chase Offers, BankAmeriDeals, U.S. Bank cash-back deals and American AAdvantage SimplyMiles offers. I’ve seen offers for TurboTax, H&R Block, TaxAct and Jackson Hewitt on my accounts in the past. But as with the shopping portal offers, the best (and most) offers will likely appear as the filing deadline nears.

You can sometimes stack shopping portal earnings with credit card merchant offers. Just be sure to enroll in the merchant offer before making your purchase and read the fine print to determine if you must use a particular link when making your purchase.

Related: If I cash out my points and miles, do I have to claim it on my taxes?

Use the right credit card

If you’re paying tax preparation fees, consider using one of the best everyday spending cards when you do so. After all, payments to most accounting firms won’t code in a way that fits into the bonus categories found on most rewards credit cards.

And, if you owe federal taxes this year, you may want to pay your taxes with a credit card. The Internal Revenue Service uses the following three third-party payment processors for tax payments by credit card:

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

- PayUSAtax: 1.82% fee (minimum fee of $2.69)

- Pay1040: 1.87% fee (minimum fee of $2.50)

- ACI Payment, Inc.: 1.98% fee (minimum fee of $2.50)

As you can see, you’ll need to pay a fee to pay your federal taxes with a credit card. But, depending on your card, it could be worthwhile. For example, you could use an American Airlines card to earn American Airlines miles and Loyalty Points. Or you could use a card for which you’re working toward minimum spending requirements for a bonus or threshold reward.

Using the Capital One Venture X Rewards Credit Card or Capital One Venture Rewards Credit Card — which would both earn 2 Capital One miles per dollar on the purchase — could also be compelling. After all, you’ll pay a 1.82% fee if you use payUSAtax, but you’d get a 3.7% return on your spending based on TPG’s valuation of Capital One miles.

However, it’s best to avoid paying with a credit card through one of the integrated IRS e-file and e-pay service providers since those carry higher fees. And we don’t recommend charging your tax bill to your credit card if you won’t be able to pay your balance in full once it becomes due.

Related: Are credit card rewards taxable?