Earn 75,000 miles plus loads of perks by applying for the Capital One Venture X

The Capital One Venture X Rewards Credit Card is a fantastic option when it comes to travel rewards credit cards.

With an annual fee that undercuts the competition and plentiful perks that are easy to understand, the card is nearly a no-brainer for travelers ranging from luxury seekers to the more budget-minded.

You can currently apply for the Venture X and earn 75,000 bonus miles after you spend $4,000 on purchases in the first three months from account opening.

According to TPG’s latest valuations, 75,000 Capital One miles are worth up to $1,388 if you use the issuer’s valuable transfer partners. All that might have you taking another look at Capital One and the Venture X. If so, here’s what you need to know about the card and its current offer.

Capital One Venture X welcome offer

The Venture X’s current sign-up bonus is 75,000 miles after you spend $4,000 on purchases in the first three months.

Capital One miles are worth one cent apiece when redeemed for travel, either directly through Capital One Travel or as a statement credit toward travel purchases. However, according to TPG’s latest valuations, 75,000 Capital One miles are worth $1,388 thanks to the program’s many airline and hotel transfer partners, which you can easily leverage for even more value.

This bonus is a selling point in and of itself, but let’s break down the card’s other features.

Key benefits of the Capital One Venture X

The Venture X is Capital One’s take on the premium travel rewards credit card.

With a $395 annual fee (see rates and fees), the card undercuts more expensive competitors in this space, such as The Platinum Card® from American Express ($695, see rates and fees) and the Chase Sapphire Reserve ($550).

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

But a competitive annual fee is just the beginning.

The Venture X confers the following benefits on cardholders:

- Earning: The Venture X earns 10 miles per dollar on hotels and car rentals booked via Capital One Travel, 5 miles per dollar on flights booked via Capital One Travel and an unlimited 2 miles per dollar on everything else.

- Annual credit: Cardmembers get $300 credit annually for bookings made through Capital One Travel.

- Anniversary bonus: The card pays 10,000 bonus miles every account anniversary, starting on your first anniversary. TPG values those 10,000 miles at up to $185 when utilized with Capital One’s transfer partners.

- Lounge access: Cardholders, authorized users and up to two guests per visit get complimentary access to Capital One Lounges, more than 1,300 Priority Pass lounges (excluding restaurants) and Plaza Premium lounges.

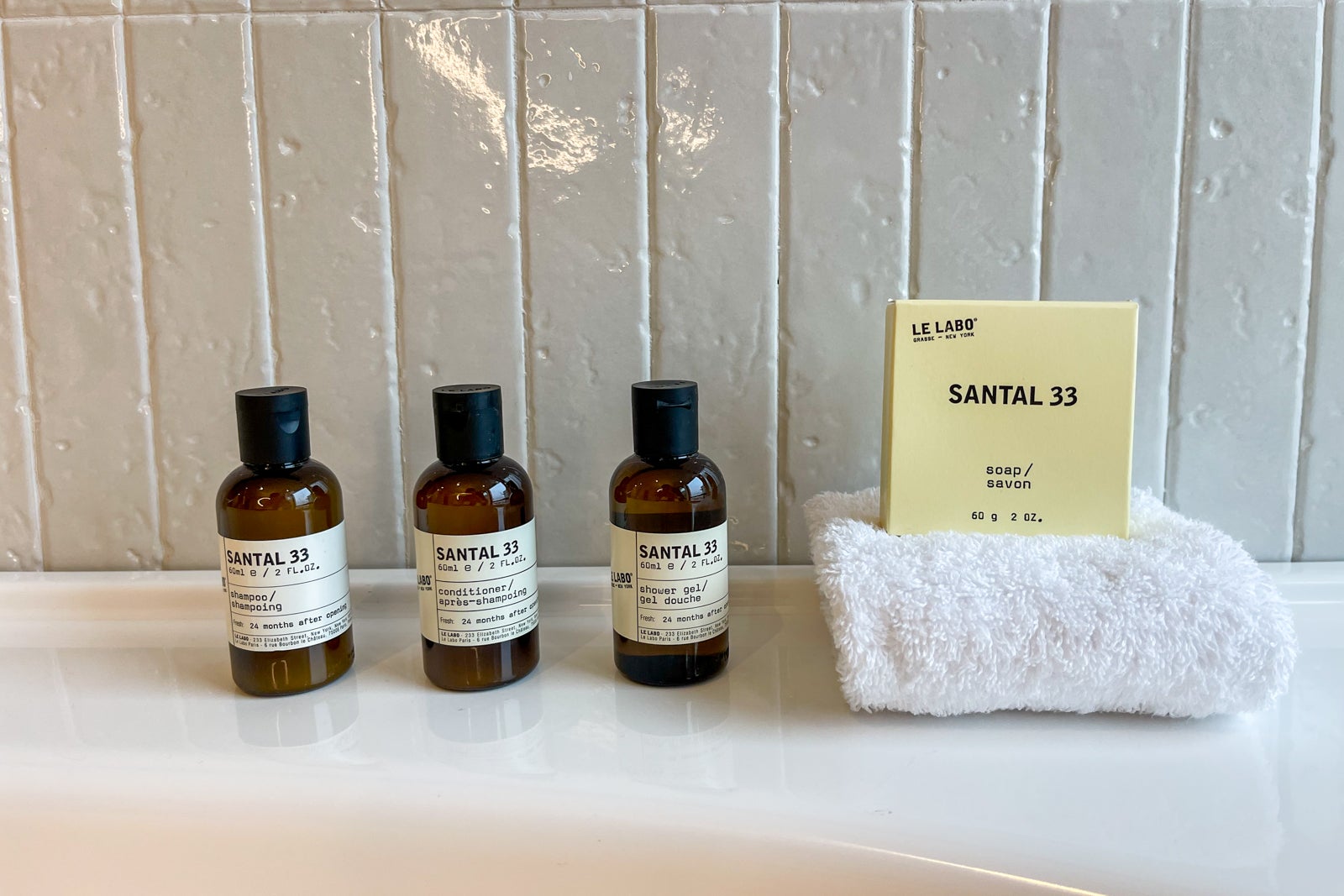

- Luxury hotel perks: The new Capital One Premier Collection offers free breakfast, room upgrades and other perks at participating hotels and resorts. Cardholders can also access Capital One’s Lifestyle Collection.

- Authorized users: Additional authorized users can be added at no charge, (see rates and fees) and they also get Capital One Lounge access with up to two guests.

- Global Entry or TSA PreCheck: Cardholders can receive up to $100 in statement credits for either TSA PreCheck or Global Entry.

- Stacking car rental perks: Cardmembers enjoy the ability to stack car rental perks with Hertz through Dec. 31, 2024.*

- Annual fee: $395 (see rates and fees)

It’s worth noting how the Venture X starts with the foundation of the Capital One Venture Rewards Credit Card, the issuer’s mainstay rewards card, and builds from there.

The Venture X features significant but unfussy perks that even inexperienced travelers can maximize. It keeps the same, simple earning structure, accruing 2 miles per dollar on most charges, complemented by elevated earning rates for bookings made via Capital One Travel and a host of other perks.

You also have the same redemption scheme with the two cards: straightforward, fixed-value options for beginners along with higher-value transfer options for the more experienced rewards users.

*Upon enrollment, accessible through the Capital One website or mobile app, eligible cardholders will remain at upgraded status level through December 31, 2024. Please note, enrolling through the normal Hertz Gold Plus Rewards enrollment process (e.g. at Hertz.com) will not automatically detect a cardholder as being eligible for the program and cardholders will not be automatically upgraded to the applicable status tier. Additional terms apply.

How does the Venture X compare?

With a $395 annual fee (see rates and fees), Venture X falls within the premium travel cards category. Two main competitors come to mind: the Amex Platinum and the Chase Sapphire Reserve.

While both of these cards come with significantly higher annual fees — $550 for the Sapphire Reserve and $695 for the Platinum (see rates and fees) — they also include more perks and, in the case of the Reserve, more flexibility.

Amex Platinum: More lounges, more complexity, higher annual fee

The Amex Platinum is still the front-runner when it comes to lounge access, with its Global Lounge Collection and access to American Express Centurion Lounges, Delta Sky Clubs (when on a same-day Delta flight; limited to six annual visits from Feb. 1, 2025), Priority Pass lounges and more. Enrollment is required for select benefits.

While Capital One has lofty ambitions with its own lounge network, Amex has a significant head start with Centurion Lounges throughout the U.S. as well as in places like London (LHR) and Hong Kong (HKG).

But the Venture X is not all about lounge access; it’s also about value and simplicity. And this is where the Amex Platinum falters.

The Platinum has a somewhat dizzying laundry list of benefits and perks, including at least 10 different built-in statement credits doled out in increments from monthly to semiannually, annually and every 4-4½ years. While you can offset the card’s hefty annual fee with these included credits, it’s a lot to keep track of them.

The Venture X beats out the Platinum from the perspective of pure ease.

Chase Sapphire Reserve: More flexibility, higher annual fee

The Chase Sapphire Reserve is another key Venture X competitor. The Reserve comes with an annual statement credit perk that is perhaps one of the easiest to use — $300 toward any travel, from hotels to ride-hailing services to airlines and much more.

It’s not just Capital One that is leaning into its travel portal. Chase Sapphire Reserve cardholders also earn bonus points at similar rates to the Venture X when booking through the Chase Ultimate Rewards travel portal, with 10 points per dollar on hotel and car rental purchases and 5 points per dollar on airfare.

In addition, the Chase Sapphire Reserve has a dedicated 1.5-cent redemption rate for travel booked through its portal, significantly surpassing the 1 cent per mile you get with the Venture and Venture X cards. Coupled with travel partners, Chase Ultimate Rewards are valued at up to 2.05 cents apiece, according to TPG valuations.

However, with a $550 annual fee and just one Chase airport lounge open in the U.S., the Venture X still gives the Reserve a run for its money.

Related: Battle of the premium travel rewards cards — which is best for you?

Long-term value proposition

Here’s the math simplified: If you can maximize the $300 annual credit toward Capital One Travel, the Venture X’s annual fee (see rates and fees) effectively comes down to $95, the same annual fee as the Capital One Venture Rewards Credit Card (see rates and fees). Add in a 10,000-mile bonus for every account anniversary (worth $185, according to TPG valuations) and lounge access, and the Venture X becomes even more enticing as a must-have travel credit card.

Bottom line

The Capital One Venture X can be a great option for many travelers, and the card is only likely to become more compelling over time as Capital One continues to invest in its rewards program and its lounge network.

The Venture X fits nicely in a competitive field of premium rewards cards, including established players from Amex and Chase, and it currently offers a solid initial sign-up bonus of 75,000 miles after you spend $4,000 in the first three months.

If you value simplicity, a user-friendly travel portal and a growing network of airport lounges, consider adding the Venture X card to your wallet today.

And if you’re curious how the personal Venture X compares to the Venture X Business, check out our card showdown.

Apply here: Capital One Venture X with 75,000 bonus miles after you spend $4,000 on purchases in the first three months from account opening

For rates and fees of the Amex Platinum Card, click here.