Amex pay over time: The ultimate guide

Card issuers are in the business of loaning money, and American Express creatively offers financing options to customers. Today, we will look at everything you need to know about Amex’s Pay Over Time feature, including how you can earn bonus points by signing up.

What is Amex Pay Over Time?

America Express Pay Over Time is a repayment feature offered on specific American Express cards. It provides cardmembers with flexibility in paying off their Amex card and carrying a balance. Despite American Express marketing some of its cards as charge cards, meaning they must be paid off in full each month, this feature allows you to carry a balance and accrue interest like a traditional credit card.

And like carrying a balance on many traditional credit cards, Amex Pay Over Time charges a hefty interest rate. This means that carrying large balances can add up to hundreds of dollars a month to your bill.

Related: A comparison of the top ‘buy now, pay later’ services — and what to watch out for

How does Amex Pay Over Time work?

Qualifying charges for Amex Pay Over Time vary by card. For example, an eligible charge for The Platinum Card® from American Express and the American Express® Gold Card must be $100 or more, whereas any purchase on the Amex Green card is eligible.

Eligible charges on your Amex card are automatically added to your Pay Over Time account, so it’s a good idea to keep an eye on your statement closing date to ensure you pay off your balance in full and avoid interest charges.

The information for the Amex Green Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Amex Pay Over Time has no present spending limit, but American Express determines how much you can finance. I have a Pay Over Time finance limit of $40,000 on my Amex Platinum and cannot exceed this amount despite having no present spending limit on the card. If I am at the limit for Pay Over Time, I must pay down the balance before having other charges automatically added to it.

Pay Over Time can be paid off in a few ways. Cardmembers can pay off the entire balance each (which also avoids interest charges), pay the minimum balance or pay any amount above the minimum balance.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

How to enroll in Amex Pay Over Time

The Amex Platinum, Amex Gold and Amex Green come auto-enrolled with Pay Over Time, so cardholders can choose to pay their statement balances in full or carry a balance with interest on eligible charges up to their Pay Over Time limit.

Select Amex business cards are automatically enrolled in Pay Over Time. Those cards include:

The information for the Business Green Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Pay Over Time has been an opt-in option feature for a long time across Amex’s business cards, but the feature will now be automatically embedded into these cards. This takes some of the guesswork out for business cardholders and eliminates a few steps that were previously required to take advantage of the feature.

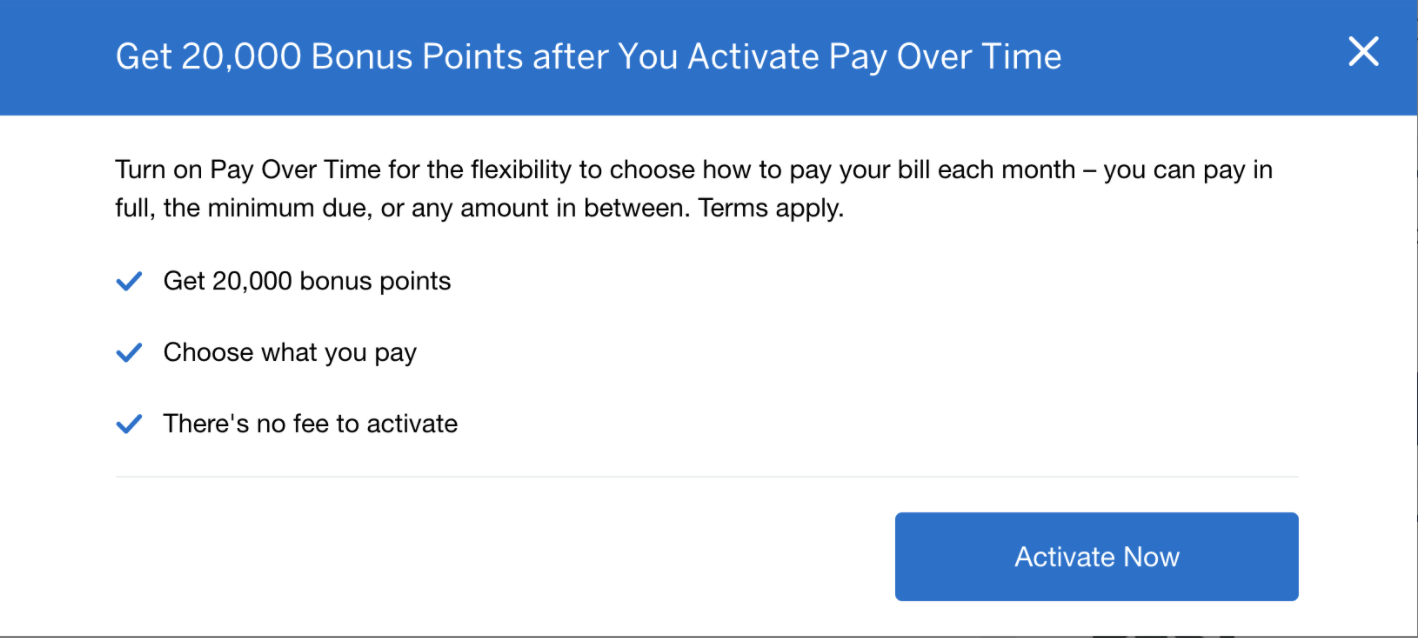

Amex also frequently offers targeted bonuses to entice customers to enroll in Pay Over Time. We’ve seen offers such as 20,000 Membership Rewards points for enrolling (worth $400 based on TPG’s valuations), and the offers tend to be targeted not to specific card accounts.

Most importantly, you don’t actually need to use Pay Over Time to earn the bonus — you simply have to enroll in this feature.

Related: Amex cardmembers: Check if you’re targeted for up to 20,000 points by enrolling in Pay Over Time

How to increase Amex Pay Over Time limit

Like a traditional credit card, Amex Pay Over Time has a limit that cannot be exceeded. Although your Amex card may not have a preset spending limit, Pay Over Time can limit how much you can charge to the card and carry as a balance month to month.

Your Pay Over Time can be increased to give you more flexibility when financing larger purchases. Just as an issuer can increase your line of credit based on positive factors such as credit utilization, good credit history, and on-time payments, Pay Over Time works the same way.

My Pay Over Time limit used to be $20,000, and over the last year and a half, I’ve seen it increase to $40,000. If you build your trust with Amex and continue engaging in positive credit card practices, you’ll likely see the Pay Over Time limit increase. You won’t be notified if Amex decides to increase your limit, so keep an eye on your monthly statements and take note of any changes.

You can also request an increase to your Pay Over Time limit by logging into your account, navigating to Account Services, and then clicking on Request Pay Over Time Limit Increase. You can enter your new desired Pay Over Time limit and Amex will let you know if you’re request is approved or denied.

How to turn off Amex Pay Over Time

You can easily deactivate Pay Over Time by calling customer service using the number on the back of your Amex card, logging into your account, navigating to Pay Over Time, and selecting the inactive option. Any changes made will be effective immediately. This means you’ll need to pay off your entire balance on the card once you’ve deactivated Pay Over Time. Your account could be subject to late fees and other penalties if you don’t.

Also, note that you must deactivate Pay Over Time for each card if you have multiple cards enrolled in Amex Pay Over Time.

Related: How to consolidate and pay off your debt

Does Amex Pay Over Time affect my credit score?

American Express cards that offer Pay Over Time have no preset spending limit. This means that when your account is reported to the credit reporting agencies each month, they only see your total account balance and cannot compare it to the credit limit.

For example, if you have a Chase Sapphire Reserve® and are using $2,000 of your $10,000 credit limit, the credit reporting agencies will mark your credit utilization as 20% for that specific card. But since you don’t have a present limit on your Amex card, using Amex Pay Over Time won’t affect your credit score in this way.

According to American Express, your Pay Over Time limit is not reported for personal or business cards and won’t impact your credit score. As long as you continue to make minimum payments, your account will be in good standing with American Express.

Still, be aware that carrying a balance and accruing interest chips away at any rewards you earn on your card.

Related: The best way to pay your credit card bills

Is Amex Pay Over Time worth it?

Although the flexible financing with Amex Pay Over Time is a nice option to have in the case of an emergency, this is not something you’ll want to actively plan on using in most cases. The rapidly accruing interest will overshadow the value of any free travel you might be earning.

For example, my Amex Platinum currently carries a 23.49% APR for Pay Over Time purchases, which is lower than many premium travel rewards cards — but still much higher than the value of the rewards I earn using the card. The current variable APR is 21.24% to 29.24% on eligible Pay Over Time purchases.

Another option worth looking into is American Express’s Plan It program on personal cards. This is a simple financing option that allows you to pay for eligible purchases over $100 in monthly installments. You’ll be charged a fixed monthly fee rather than accruing interest, so you’ll know exactly how much you owe each month. Your monthly fee may be lower than the interest that is charged to your Pay Over Time purchases, making this a better option in some cases.

Related: Amex adds new payment options to Green, Gold and Platinum cards

Bottom line

Amex has been actively expanding its extended financing options. However, the fees and interest rates mean you should only consider these programs as last-ditch options if you suddenly cannot pay your bill. Even if you have no intention of ever using Pay Over Time, you could earn bonus Membership Rewards points over the years by enrolling in various cards in targeted offers, so keep your eyes peeled for any future deals.

For rates and fees of the Amex Platinum, click here.