Airlines jockey for 5 new long-distance slots from DCA

The bidding has begun. Several airlines are throwing their hat into the ring, hoping to win the right to operate more long-distance flights from Ronald Reagan Washington National Airport (DCA).

That comes after Congress last week signed off on five additional exceptions to a decades-old (but increasingly permeable) rule that says airlines can’t fly from DCA to destinations beyond 1,250 miles.

Already, American Airlines announced it hopes to launch new nonstop service from DCA to San Antonio International Airport (SAT) in Texas, an airport that’s only about 130 miles beyond the current perimeter restrictions.

Alaska Airlines has revealed it hopes to bolster its DCA footprint with a new transcontinental flight from San Diego International Airport (SAN), where it’s been growing at a fast pace of late.

And late Monday, Southwest Airlines said it hopes to launch a new flight to Harry Reid International Airport (LAS) in Las Vegas.

Want more aviation news? Sign up for TPG’s free biweekly Aviation newsletter.

Whether it’s those routes or others that ultimately get approved now lies in the hands of the U.S. Department of Transportation.

What is far more certain is that new flight options are coming to the airport closest to our nation’s capital in the not-so-distant future.

Not everyone is happy about it.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Strict rules — with lots of exceptions

Historically, the mantra in the Washington region is that DCA gets the shorter flights, and Dulles International Airport (IAD) gets the longer ones — not just as it relates to Dulles’ vast international schedule, but to domestic flights, too.

For decades, the Federal Aviation Administration has closely governed takeoffs and landings at Reagan. Since the mid-1980s, airlines have been restricted from operating DCA-based flights that stretch beyond 1,250 miles in distance — a distance that grew from its original restriction of 650 statute miles.

The rule was designed to be a tool to manage capacity at the space-constrained Reagan, with a goal to send bigger planes and longer flights — and the lion’s share of the region’s flight growth — to Dulles, which sits on a far larger footprint, 26 miles to the west in Northern Virginia.

Because of that so-called perimeter line, airlines — theoretically — aren’t supposed to fly from Reagan beyond the Dakotas, western Nebraska or Kansas, or eastern Texas (notably, Houston and Dallas are inside that “perimeter,” though).

Slots and perimeter rules, explained: The little-understood government rule that allows airlines to dominate certain airports

Exceptions made through the decades

But, since the turn of the century, Congress has authorized one exception after another. They’ve come in the form of “beyond perimeter exemptions” that have given airlines limited leeway to fly specific routes beyond that not-so-proverbial line of demarcation.

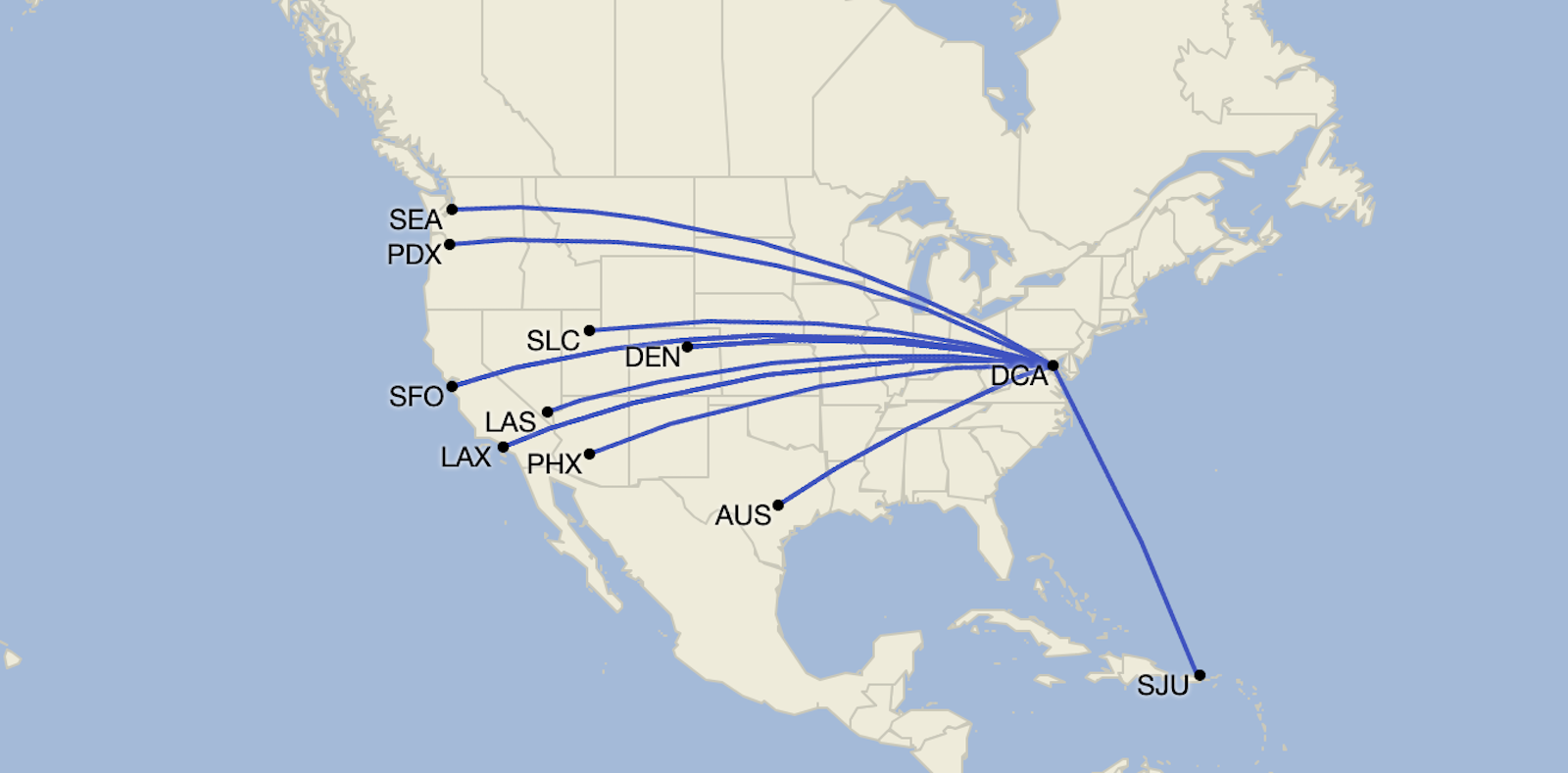

Today, the rules (or exceptions to those rules, more precisely) allow airlines up to 20 round trips beyond the perimeter to specific airports, as shown on the below map from aviation analytics firm Cirium.

Cities currently authorized for beyond-perimeter slots include:

- Austin (once daily on Southwest — or one “slot pair,” which includes a daily takeoff and landing)

- Denver (three slot pairs for Frontier Airlines, one for United Airlines)

- Las Vegas (one slot pair for American)

- Los Angeles (two slot pairs for American, one for Alaska, one for Delta Air Lines)

- Phoenix (three slot pairs for American)

- Portland, Oregon (one slot pair for Alaska)

- Salt Lake City (one slot pair for Delta)

- San Francisco (one slot pair for Alaska, one for United)

- San Juan, Puerto Rico (one slot pair for JetBlue)

- Seattle (two slot pairs for Alaska)

This mounting list of beyond-perimeter flights has fueled some pretty jarring air travel trends at the region’s airports over the past two decades.

At Reagan, airlines will fly with 31% more seats in 2024 than 2004, per Cirium. But its seats on flights greater than 1,250 miles in length are up193% versus 20 years ago.

Meanwhile, Dulles has doubled down on international service, with those seats up 107% in 2024 versus 2004. But its seats to the U.S. and Canada (aka regions served by DCA) are down by 25% versus 20 years ago.

And it’s likely the trend — at DCA, at least — will become even more stark in the coming months.

FAA bill grants 5 more slots

Last week, Congress opened the door to five more beyond-perimeter exemptions in passing the larger FAA funding bill. It was a controversial move, to be sure.

Lawmakers from Virginia and Maryland fought against adding more long-distance flights from Reagan, arguing the airport’s runway is already too busy — an argument underscored, they said, by a recent high-profile close call there.

The Metropolitan Washington Airports Authority, which oversees Dulles and Reagan, still isn’t pleased with the added slots, which, it told TPG, “will exacerbate delays, cancellations and stress on airport infrastructure.”

Which cities might get DCA service?

But, the additional flights are coming.

And it’s now up to the DOT to decide which airlines — and which cities — will get the additional beyond-perimeter slots at DCA.

Under the law, signed Thursday by President Joe Biden, the DOT will have to consider new routes to cities not currently served by DCA — and service that might “have a positive impact on the overall level of competition” in existing markets.

Airlines and cities have been quick to appeal to the DOT.

“San Antonio is one of the fastest growing cities in the country and is the largest unserved market in Texas from DCA,” American Executive Vice President Nate Gatten said in a joint statement with the city of San Antonio, signaling the Fort Worth-based carrier plans to apply for a slot to the Texas city.

Alaska likewise pointed publicly to San Diego as a potential city it sees as worthy of a slot. San Diego is easily the largest West Coast city without any DCA nonstop service, Alaska’s chief commercial officer said in a statement Thursday.

American previously operated a DCA flight to San Diego over a decade ago, but ended that route in 2014 as part of divestitures the airline was required to make to win approval of its merger with US Airways.

There’s more slot-jockeying underway, too.

Southwest’s proposed DCA-to-Vegas flight “would provide airline consumers with much-needed choices and competition,” the Dallas-based carrier said late Monday — while revealing plans to offer one-stop, no plane-change service to Sacramento International Airport (SMF) via Las Vegas as part of the potential route.

There’s no current DCA route to California’s capital.

Delta Air Lines is also considering options for the newly available slots, a spokesperson confirmed Monday, noting the additional slots “will create much-needed competition” at Reagan.

It is worth noting that Delta lacks a DCA nonstop to just one of its beyond-perimeter hubs: Seattle-Tacoma International Airport (SEA) — with the route currently only served by Alaska.

But it’s also certainly conceivable that the Atlanta-based carrier could instead aim to bolster service to its Salt Lake City International Airport (SLC) hub, where it has just one daily flight from Reagan. No other airlines currently fly the route.

United Airlines — which operates a major hub at Dulles, but does have a presence at DCA — declined to comment.

Could JetBlue, an ultra-low-cost carrier — or even a Canadian carrier like Air Canada — successfully get in on the slot competition?

Ultimately, time will tell: The DOT has fewer than 60 days to receive applications, and make a decision.

Related reading: