Just got the Chase Sapphire Preferred? Do these 5 things next

There’s no question that the Chase Sapphire Preferred® Card is one of my all-around favorite credit cards.

Before the Chase Sapphire Reserve® launched, I used the Sapphire Preferred for years to cover most of my purchases and earned 2 points per dollar on all travel and 3 points per dollar on dining — two broad categories that cover far more than just the obvious restaurants and hotels.

Those fully transferable points are incredibly valuable, with all sorts of redemption options and popular transfer partners. Add in the current sign-up bonus — 75,000 bonus points after you spend $4,000 on purchases in the first three months from account opening — and it’s easily one of the best travel credit cards out there, especially for beginners getting into the points and miles game.

If you just got your Chase Sapphire Preferred, make sure you take these steps to maximize your card and its points from day one.

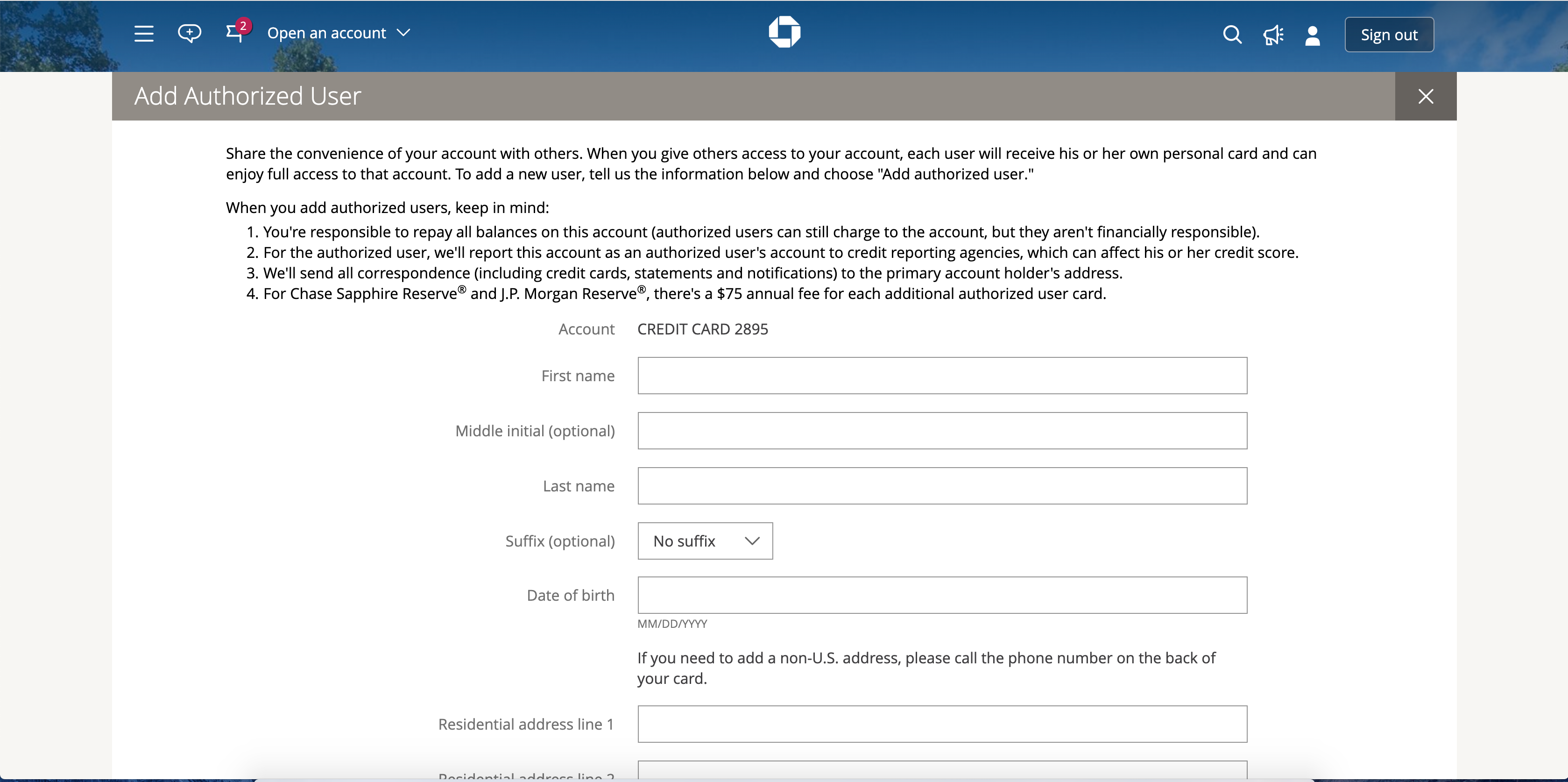

Consider adding an authorized user

Having an authorized user on your Sapphire Preferred account lets you earn points faster and makes it easier to hit the card’s spending threshold to earn the current sign-up bonus.

It can also enable you to transfer the points to one of Chase’s airline or hotel partner programs in the name of one household member who is also an authorized user on your card.

Plus, the process to add an authorized user online is simple and takes less than a minute.

Related: Want to build credit history for your kids? Add them as an authorized user

Add your card to takeout and delivery apps

Adding the Chase Sapphire Preferred to delivery services such as Seamless and Grubhub will maximize your point-earning ability since you get 3 points per dollar on all dining purchases.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Of course, if you have other cards that earn extra points for dining at restaurants, such as the American Express® Gold Card (4 points per dollar spent on dining at restaurants), you may want to use those cards instead. Regardless, add your card to dining rewards programs to earn bonus points for eating at restaurants.

And you definitely don’t want to forget DoorDash. When you add your Sapphire Preferred as the primary payment on your DoorDash account and activate this benefit, you’ll get a complimentary DashPass membership. This will allow you to enjoy $0 delivery and reduced service fees on eligible orders, and you will have at least one year with this benefit if you activate by Dec. 31, 2024.

Related: Best dining credit cards

Set the card as your default for future travel

When you pay for travel with the Sapphire Preferred, you’ll earn 2 points for every dollar spent, even on expenses such as tolls and monthly parking.

Based on TPG’s valuations, this equals a more than 4% return on spending. If you book travel through Chase Travel℠, you’ll earn 5 points per dollar spent, equivalent to a return of over 10%.

When taking a Lyft ride charged to your Sapphire Preferred, you’ll earn 5 points per dollar until March 2025.

Chase defines travel very broadly:

“Merchants in the travel category include airlines, hotels, motels, timeshares, car rental agencies, cruise lines, travel agencies, discount travel sites, campgrounds and operators of passenger trains, buses, taxis, limousines, ferries, toll bridges and highways, and parking lots and garages.”

This means that using the Sapphire Preferred for any of these items will earn you 2 points for every dollar you spend.

Not only that, but the card comes with some built-in travel protections that make it a really smart choice when booking your next flight, rental car or other prepaid travel expense.

Update your rental car profile

Adding your Chase Sapphire Preferred information to your various rental car profiles lets you take advantage of the card’s primary rental car coverage, giving you valuable peace of mind when traveling.

Plus, car rentals count as travel and thus earn 2 points per dollar, so you’ll get double points and enhanced protections.

Related: Best credit cards for rental car coverage

Complete the Chase quartet

When the time is right for you to get your next card, adding the Ink Business Preferred® Credit Card, Chase Freedom Flex℠ and/or Chase Freedom Unlimited® to your wallet will allow you to build up your Ultimate Rewards balance even faster.

For example, with the Ink Business Preferred, you can earn 3 points per dollar on the first $150,000 spent each account anniversary on travel, shipping purchases, internet, cable, phone services and advertising purchases made with social media sites.

Meanwhile, the Freedom Unlimited offers 1.5% cash back on purchases, but that cash back comes in the form of Ultimate Rewards points that can be combined with the ones from your Sapphire Preferred card and transferred to valuable airline and hotel partners.

Finally, the rotating quarterly categories on the Chase Freedom Flex let you earn 5 points per dollar with specific types of merchants, on up to $1,500 in spending per quarter (activation required).

Additionally, keep Chase’s 5/24 rule in mind; the issuer won’t approve your application for additional credit cards if you’ve opened five or more credit cards (from any bank) in the last two years. As a result, make sure you sign up for these cards before adding others to your portfolio.

Related: Best Chase credit cards

Bottom line

After more than a decade, we still love and recommend the Chase Sapphire Preferred. It’s an excellent earner with tons of perks and an annual fee under $100. With a 75,000-point welcome bonus, it’s a great time to add the Sapphire Preferred to your wallet.

Follow the steps outlined above to maximize your point earning and take full advantage of this card’s related benefits. Once you’ve earned the welcome bonus, you can use your stash of valuable Ultimate Rewards points as you see fit.

Apply here: Chase Sapphire Preferred Card