How to redeem American Express Membership Rewards for maximum value

Loyalty programs can be complex, making it difficult to uncover the best ways to maximize your credit card rewards. For example, American Express Membership Rewards offers numerous redemption options through Amex’s transfer partners. However, figuring out the most valuable ways to utilize these points can be challenging.

We’ll explore the strategies you should consider to help make the most of your hard-earned Amex Membership Rewards points.

How to earn American Express Membership Rewards points

Accumulating a substantial amount of Membership Rewards points is straightforward, thanks to the wide range of Amex cards available. Among the various Amex cards offering bonus categories that earn the most points and significant additional perks, these five popular options stand out.

The Platinum Card® from American Express

Amex Platinum: Earn 80,000 Membership Rewards Points after you spend $8,000 on purchases within the first six months of card membership.

Earning points:

- 5 points per dollar spent on airfare purchased directly through airlines or through Amex Travel (on up to $500,000 on these purchases per calendar year, then 1 point per dollar)

- 5 points per dollar spent on prepaid hotels booked with Amex Travel

- 1 point per dollar spent on other purchases

Annual fee: $695 (see rates and fees)

American Express® Gold Card

Amex Gold Card: Earn 60,000 Membership Rewards points after you spend $6,000 on eligible purchases with your new card within the first six months of card membership. However, some readers have been targeted for an even higher welcome offer using the CardMatch tool (offer subject to change at any time).

Earning points:

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

- 4 points per dollar spent at restaurants worldwide

- 4 points per dollar spent at U.S. supermarkets (on the first $25,000 in purchases per calendar year, then 1 point per dollar spent)

- 3 points per dollar on airfare purchased directly through airlines or through Amex Travel

- 1 point per dollar spent on other eligible purchases

Annual fee: $250 (see rates and fees)

The Business Platinum Card® from American Express

Amex Business Platinum: Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with the Business Platinum Card within the first three months of card membership.

Earning points:

- 5 points per dollar spent on flights and prepaid hotels booked through Amex Travel

- 1.5 points per dollar spent in select business categories and eligible purchases of $5,000 or more on up to $2 million of these purchases per calendar year (then 1 point per dollar spent).

- 1 point per dollar spent on other eligible purchases

Annual fee: $695 (see rates and fees)

American Express® Business Gold Card

Amex Business Gold Card: Earn 70,000 bonus points after you spend $10,000 on eligible purchases in the first three months of card membership.

Earning points:

- 4 points per dollar spent in the two categories your business spends the most each billing cycle from six eligible categories. You’ll earn 4 points per dollar spent on the first $150,000 in combined purchases each calendar year (then 1 point per dollar).

- 3 points per dollar spent on flights and prepaid hotels booked through AmexTravel.com

- 1 point per dollar spent on other eligible purchases

Annual fee: $375 (see rates and fees)

American Express® Green Card

Amex Green Card: Earn 40,000 Membership Rewards points after you spend $3,000 on purchases within the first six months of card membership.

Earning points:

- 3 points per dollar spent on dining at restaurants worldwide and takeout and delivery in the U.S.

- 3 points per spent dollar on travel and transit

- 1 point per dollar spent on other eligible purchases

Annual fee: $150 (see rates and fees)

The information for the American Express Green Card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

Other options for earning Amex points

With an Amex card, you can maximize your points through Rakuten, a favorite TPG online shopping portal. You’ll earn bonus Amex points for each dollar spent by clicking through Rakuten to participating merchant websites.

Another way to earn extra Membership Rewards points is through targeted offers. Amex frequently allows cardholders to earn bonus points by adding authorized users and meeting specific spending requirements. Referring a friend or small business to apply for an Amex card can also earn you a bonus once they’re approved. Lastly, retention calls can be a good way to add points to your balance.

How can I Redeem my Membership Rewards for maximum value?

If you want solid value from your Membership Rewards points, transferring them to partner hotel or airline loyalty programs is often your best bet.

When you convert points into a hotel or airline currency, you can redeem them for free hotel nights and award flights that might otherwise be quite costly. Moreover, you might stretch the value of your points even further by taking advantage of periodic transfer bonuses to specific partners.

Here are some of the best programs to transfer your points to and examples of redemptions.

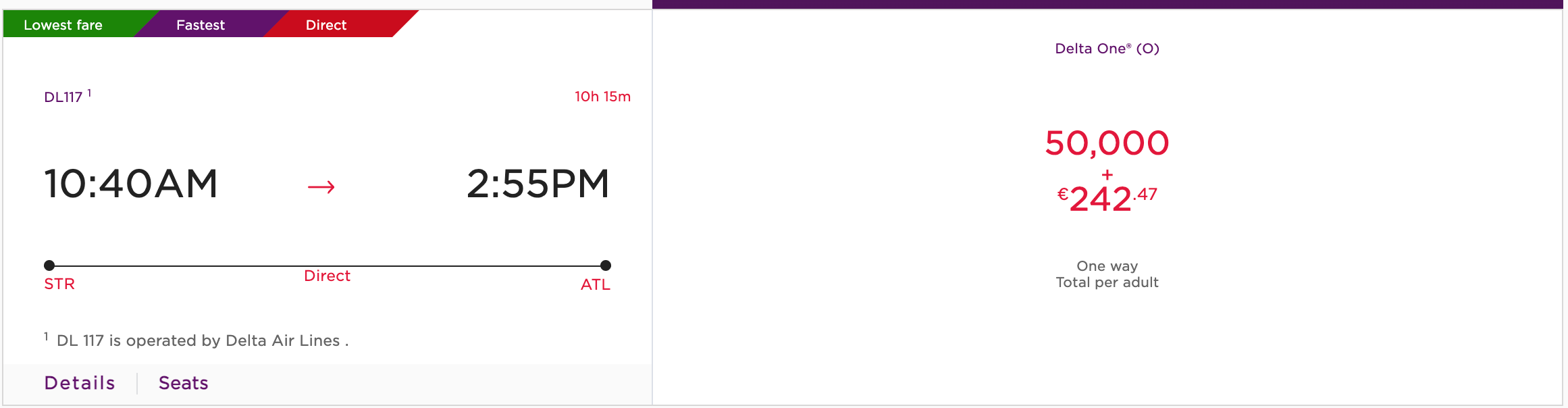

Book Delta flights to Europe (with no fuel surcharges) and ANA first class through Virgin Atlantic

Virgin Atlantic Flying Club gutted its Delta award chart, leaving one sweet spot behind: business-class flights to Europe (excluding the United Kingdom).

You can book one-way Delta flights from the U.S. to Europe in Delta One business class for just 50,000 points. This is an excellent deal, especially since you don’t have to pay fuel surcharges — though be aware that Virgin Atlantic does pass on Delta’s Europe origination surcharge for itineraries that begin on the continent.

If you can, book flights equipped with Delta One Suites for the best experience.

Unfortunately, the rest of Virgin Atlantic’s Delta award chart is distance-based and not particularly useful. Booking short-haul Delta domestic tickets with the program can sometimes make sense if cash fares are expensive. You can book flights 500 miles or shorter in economy class for just 7,500 points. Just check Delta SkyMiles (another Amex transfer partner) first to see if it has a better price.

Another time you might transfer to Virgin Atlantic Flying Club is to book ANA business- and first-class tickets. Even with its March devaluation, you can book a one-way flight to Japan from the U.S. West Coast for 45,000 (business class) and 72,500 points (first class).

Related: When and how to book Delta awards with Virgin Atlantic Flying Club

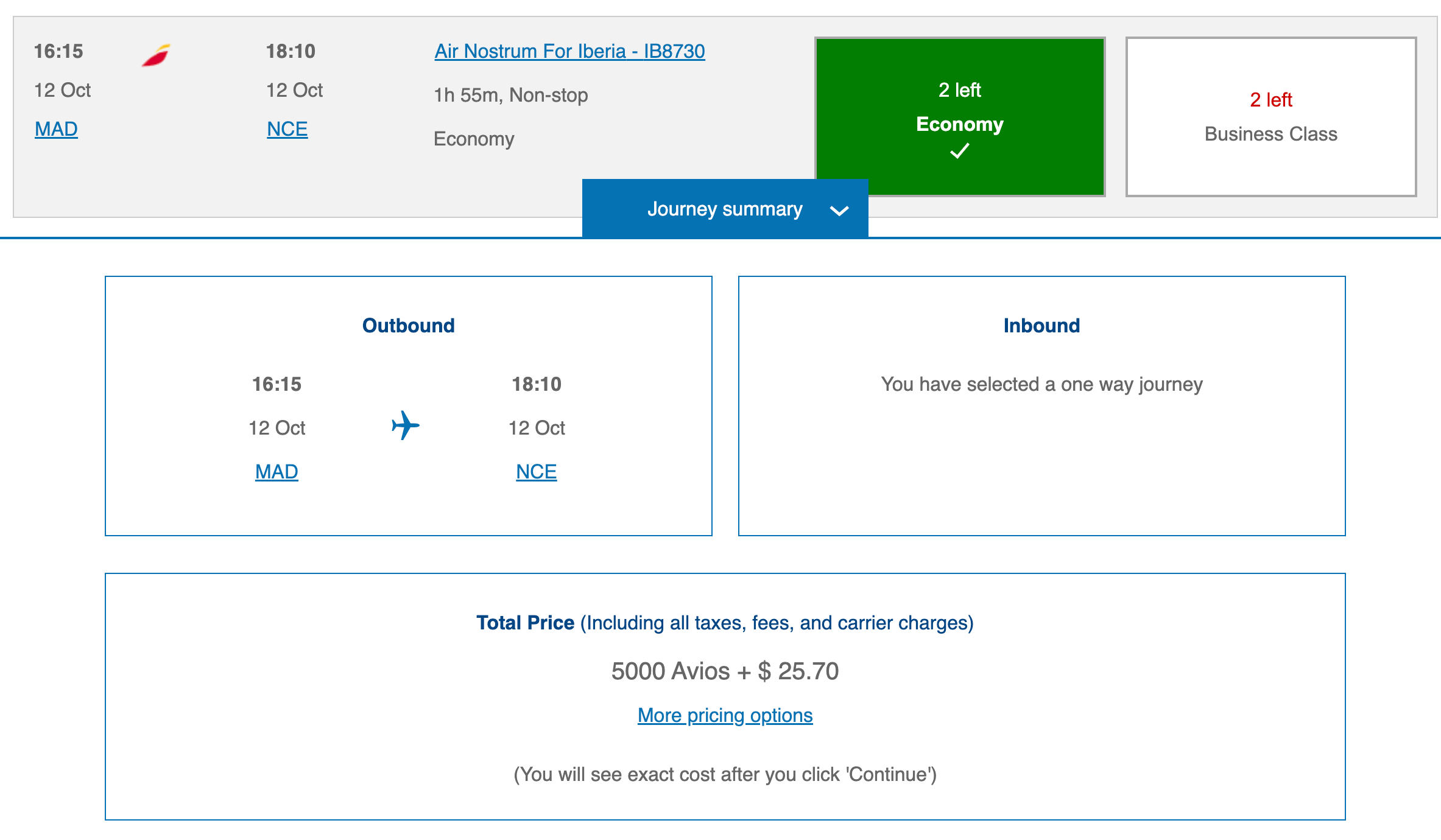

Book Oneworld economy flights using British Airways Avios

You can transfer Amex Membership Rewards points to British Airways at a 1:1 transfer ratio. The program regularly offers transfer bonuses that allow you to maximize its distance-based award chart. However, even without a bonus, there’s still a lot of value in the program.

For instance, many routes from the East Coast of the U.S. to Dublin on Aer Lingus are under 4,000 miles in length. You can book these flights in economy class for just 26,000 Avios round trip on off-peak dates. You can also fly short haul outside of North America for as few as 5,000 Avios.

Domestic U.S. flights under 600 miles cost 7,500 Avios in economy class, and flights between 601 and 1,151 miles cost 9,000 Avios. This can be a good deal on last-minute fares on business-heavy routes, like New York’s LaGuardia Airport (LGA) to Ronald Reagan Washington National Airport (DCA).

Perhaps the best use of Avios is flying from the West Coast to Hawaii on American Airlines or Alaska Airlines for just 13,000 Avios each way.

Related: Maximizing the British Airways distance-based award chart

Fly round-trip to Madrid on Iberia

One of the best ways to redeem Amex points is by booking Iberia business class on off-peak dates. This can be a terrific use of your points, especially when considering the low points price and minimal fuel surcharges.

Iberia flights from the U.S. to Barcelona and Madrid start at just 17,000 Avios one-way in economy and 34,000 in business class. You’ll find the cheapest flights from cities on the East Coast, but other cities have attractive pricing too. Here’s a look at Iberia’s award chart:

| Destination to/from Madrid | Blue class/economy | Premium economy | Business | |||

|---|---|---|---|---|---|---|

| Off-peak | Peak | Off-peak | Peak | Off-peak | Peak | |

| New York’s John F. Kennedy International Airport (JFK) | 17,000/22,000 | 20,000/28,000 | 25,500 | 35,000 | 34,000 | 50,000 |

| Chicago’s O’Hare International Airport (ORD) | 21,250/27,750 | 25,000/35,000 | 31,750 | 43,750 | 42,500 | 62,500 |

| Dallas Fort Worth International Airport (DFW) | 21,250/27,750 | 25,000/35,000 | 31,750 | 43,750 | 42,500 | 62,500 |

| Boston Logan International Airport (BOS) | 17,000/22,000 | 20,000/28,000 | 25,500 | 35,000 | 34,000 | 50,000 |

| Miami International Airport (MIA) | 21,250/27,750 | 25,000/35,000 | 31,750 | 43,750 | 42,500 | 62,500 |

| Los Angeles International Airport (LAX) | 25,550/33,250 | 30,000/42,000 | 38,250 | 52,500 | 51,000 | 75,000 |

| San Francisco International Airport (SFO) | 25,550/33,250 | 30,000/42,000 | 38,250 | 52,500 | 51,000 | 75,000 |

Snagging a round-trip economy award flight to Europe for just 34,000 miles (or business class for 68,000 miles) can be fantastic. Also, availability isn’t too difficult to find when traveling on off-peak dates.

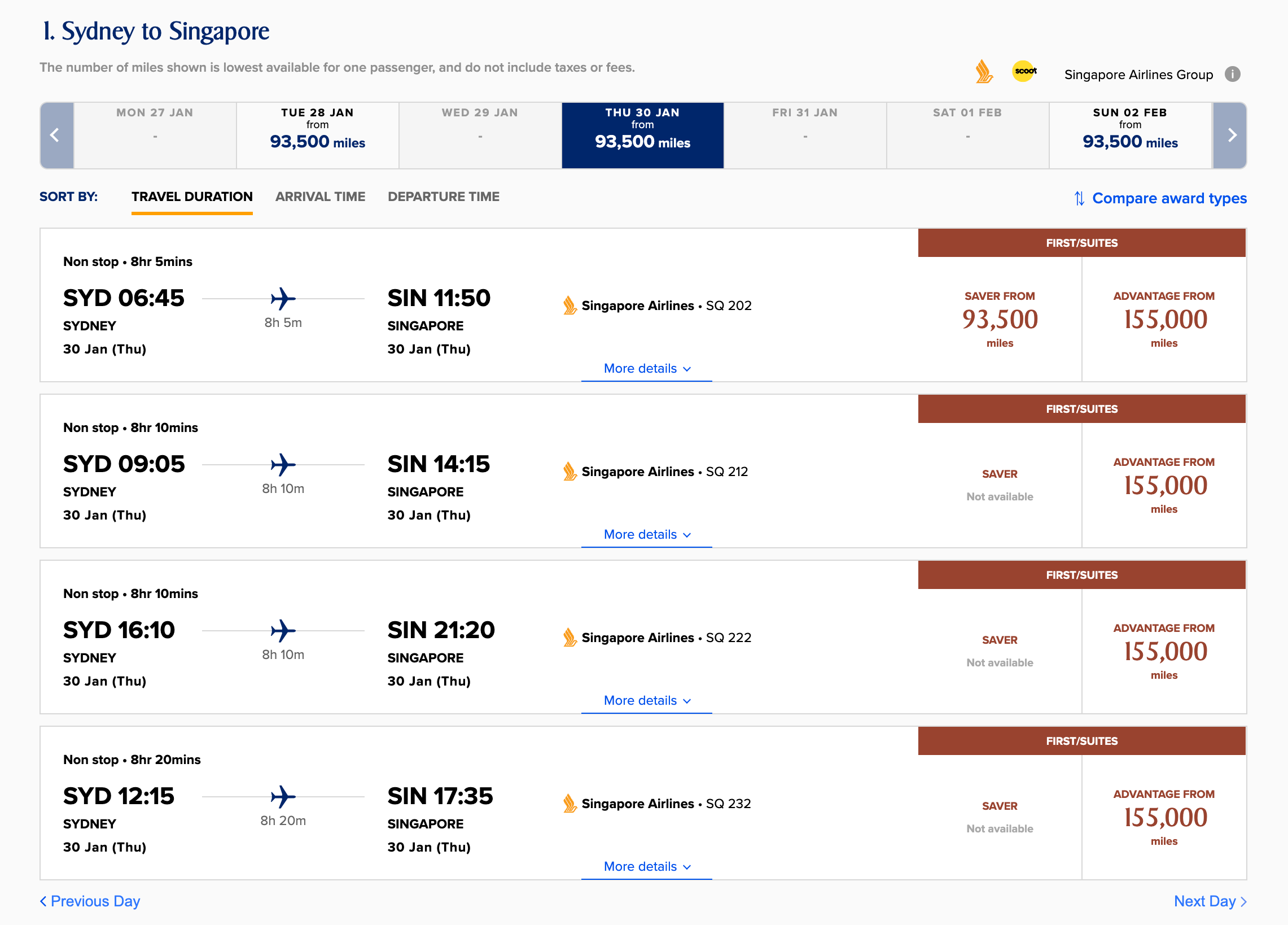

Fly Singapore Airlines premium classes

Using your miles for any Singapore Airlines-operated flight can be a great deal, even after multiple devaluations. With the carrier’s renowned Suites class, you’ll be hard-pressed to find a more luxurious seat in the sky.

You can fly the first-class suites on the A380 for 93,500 Membership Rewards if you book a one-way flight between Singapore Changi Airport (SIN) and Sydney Airport (SYD). While Singapore no longer flies the A380 to the U.S., you can still book first class on the carrier’s 777-300ER from New York to Frankfurt, Germany, for 97,000 miles. However, you must find saver availability, which can be challenging. Advantage award space is more plentiful but will cost 155,500 miles one-way.

Singapore Airlines KrisFlyer miles are among the easiest currencies to earn. The program is a 1:1 transfer partner with American Express Membership Rewards, but you can also top up your account using Capital One miles, Chase Ultimate Rewards points and Citi ThankYou Rewards points.

Related: How to book Singapore Airlines first-class Suites with points and miles

Transfer to Flying Blue for flights to Europe and North Africa

Flying Blue is Air France and KLM’s joint loyalty program. The program prices award tickets dynamically and often has good deals on flights from North America to Europe and North Africa. These flights start at 20,000 miles one-way in economy and 50,000 miles in business class.

Bear in mind that fuel surcharges on these awards can be a little hard to handle — close to $400 per person if you book round-trip business-class flights. However, 40,000 miles for round-trip economy flights and about $120 in cash is still a great deal. There are also occasional bonuses for transferring points from American Express to Flying Blue, so pricing on some routes becomes even more attractive.

Flying Blue’s monthly Promo Awards are worth checking out as they can offer 25% discounts on the prices above.

Related: Flying Blue expands free stopovers on award tickets to all partner airlines

35% Pay with Points rebate for Business Platinum cardholders

The Amex Business Platinum Card has another benefit if you use points to pay for economy airfare (on the carrier you choose for your up-to-$200 airline fee statement credit) or any business- or first-class airfare booked on Amex Travel on any airline. In that case, you’ll receive back 35% of those points (up to a million bonus points per calendar year). That means a $1,000 ticket costs 65,000 points. Enrollment is required for select benefits.

However, it’s important to note that you must have enough points in your account to cover the full cost of the redemption — 100,000 points for the $1,000 ticket in the above example. Then, you’ll receive the 35% points rebate back in your Membership Rewards account within one to two billing cycles.

This may not be the absolute best value for your points, but remember that tickets booked through Amex Travel are treated as revenue fares by the airlines. This means you will generally earn redeemable and elite-qualifying miles on these tickets. If you want to skip the hassle of looking for award space and redeem points to book inexpensive fares, the Business Platinum Card can be a valuable addition to your wallet.

Related: Everything you need to know about Amex Travel

Which redemption options should I avoid?

There are many ways to redeem your Membership Rewards online. TPG values Amex points at 2 cents apiece, and while there are many options to redeem your points, most represent a poor value and should generally be avoided. They include:

- Using points for statement credits: You’ll only receive 0.6 cents per point with this option, so it’s not a good return.

- Shopping on Amazon: After linking your Amazon and Membership Rewards accounts, you can use points to pay for your purchases at a slightly better (but still poor) value of 0.7 cents per point.

- Shopping with Membership Rewards: Your points are only worth 0.5 cents each when redeemed this way.

- Redeeming for gift cards: You may redeem your points for gift cards to shops, rental car agencies, restaurants and even Airbnb. Most of the time, you redeem points for a flat value of 1 cent each.

- Redeeming for paid travel — with one exception: You can pay for travel with points through Membership Rewards. This option gives you a value of 1 cent per point toward airfare and 0.7 cents per point for cars, hotels, vacations or cruises. The exception to this rule is using The Amex Business Platinum to cover paid flights with a 35% rebate, which can represent a solid redemption.

- Low-value transfer partners: You probably won’t want to transfer Membership Rewards to programs like HawaiianMiles, Hilton Honors or Marriott Bonvoy (unless there’s a substantial transfer bonus). These programs generally lack the sweet spots the other currencies offer.

Bottom line

There are many ways to earn Amex Membership Rewards points, such as with the Amex Gold Card and Amex Business Gold Card. Like the other transferable points programs, American Express Membership Rewards offers great sweet spots to those who do their homework on the various transfer partners and potential redemptions. Take the above examples into consideration, and choose the best American Express card for you. Then, explore these options to use your points wisely for your next getaway.

For rates and fees of the Amex Green Card, click here.

For rates and fees of the Amex Platinum Card, click here.

For rates and fees of the Amex Business Platinum Card, click here.

For rates and fees of the Amex Gold Card, click here.

For rates and fees of the Amex Business Gold, click here.