FoundersCard: Is it worth paying $595 a year for elite status and discounts?

Surprisingly, I pay an annual fee for one card that is not a credit card: FoundersCard.

It is a membership community offering discounts and benefits in many different lifestyle categories. This card has many benefits, discounts and amenities that make travel easier and enhance my lifestyle.

You can get these benefits without having to apply for a credit card, but is the card worth the membership fee? Let’s dig in.

The information for the FoundersCard credit card has been collected independently by The Points Guy. The card details on this page have not been reviewed or provided by the card issuer.

What is FoundersCard?

FoundersCard is a membership program that offers elite status, travel discounts, complimentary subscriptions and special pricing with lifestyle brands. It is not a credit card, and you can’t make any purchases with it.

Despite the name, you don’t have to be a “founder” or entrepreneur to have this card; anyone is welcome to apply. The application process is short, and a decision is usually given within two days.

How much does a FoundersCard membership cost?

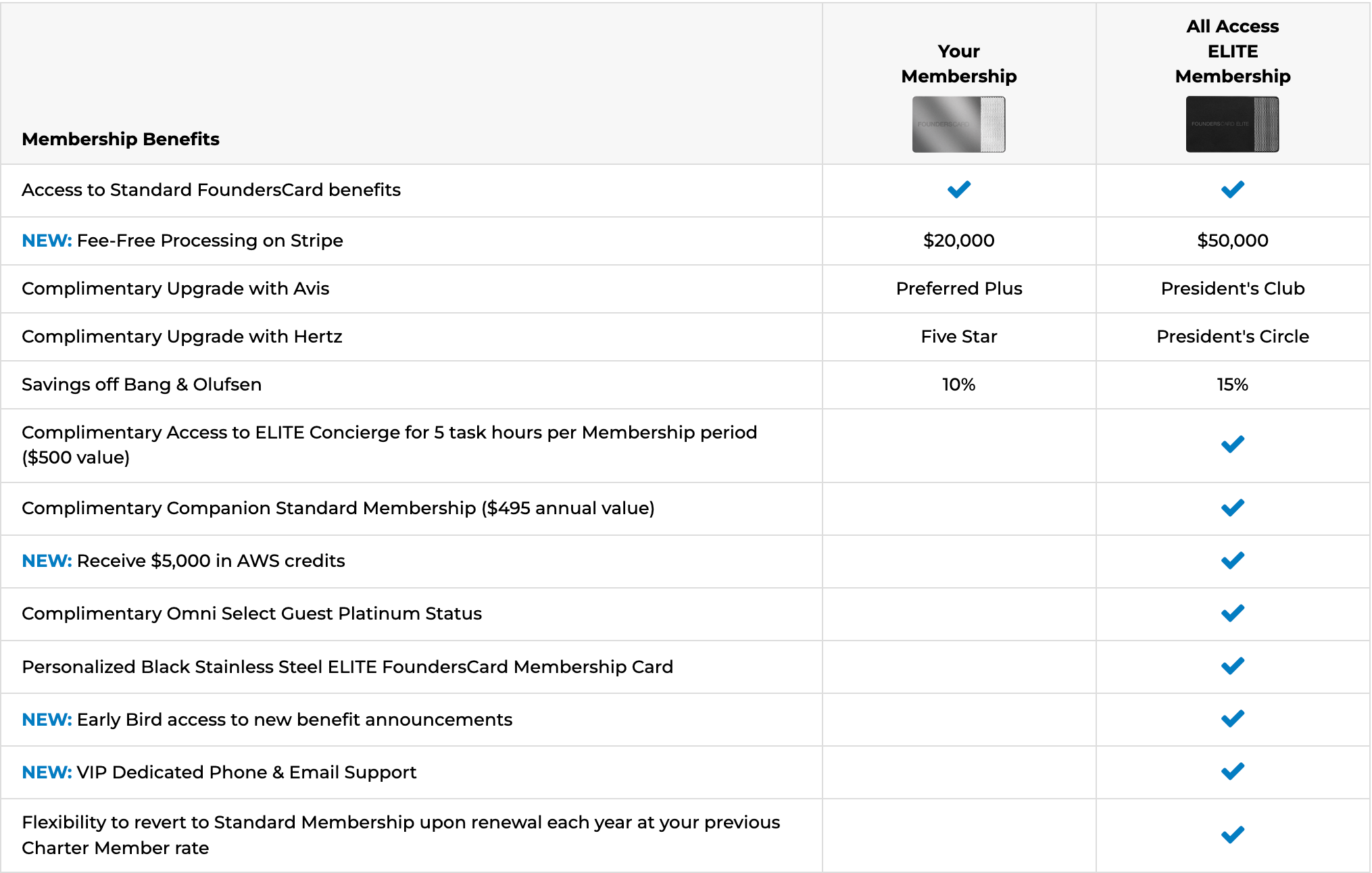

There are two membership tiers:

- Standard: $595 a year

- All Access Elite: $995 a year

You must pay an additional $95 initiation fee.

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

Occasionally, discounted membership offers are available. I have seen the standard membership go for as low as $295 a year for life. In fact, I was able to secure that rate. Given that the card provides me with outsize value, I will continue to renew my membership each year.

Here are the differences between the two membership tiers:

The standard membership is more than adequate for my needs. All the benefits, credits and discounts I receive more than cover the annual membership fee.

It’s worth noting that many of the FoundersCard benefits overlap with benefits I receive from my Business Platinum Card® from American Express, such as Hilton Honors Gold status and Hertz Five Star status*, but there are distinct benefits I use that are only available with FoundersCard.

*Enrollment in the Hertz Gold Plus Rewards Program is required

Related: A new luxury membership card promises elite perks. Is it worth the fee?

Benefits of FoundersCard

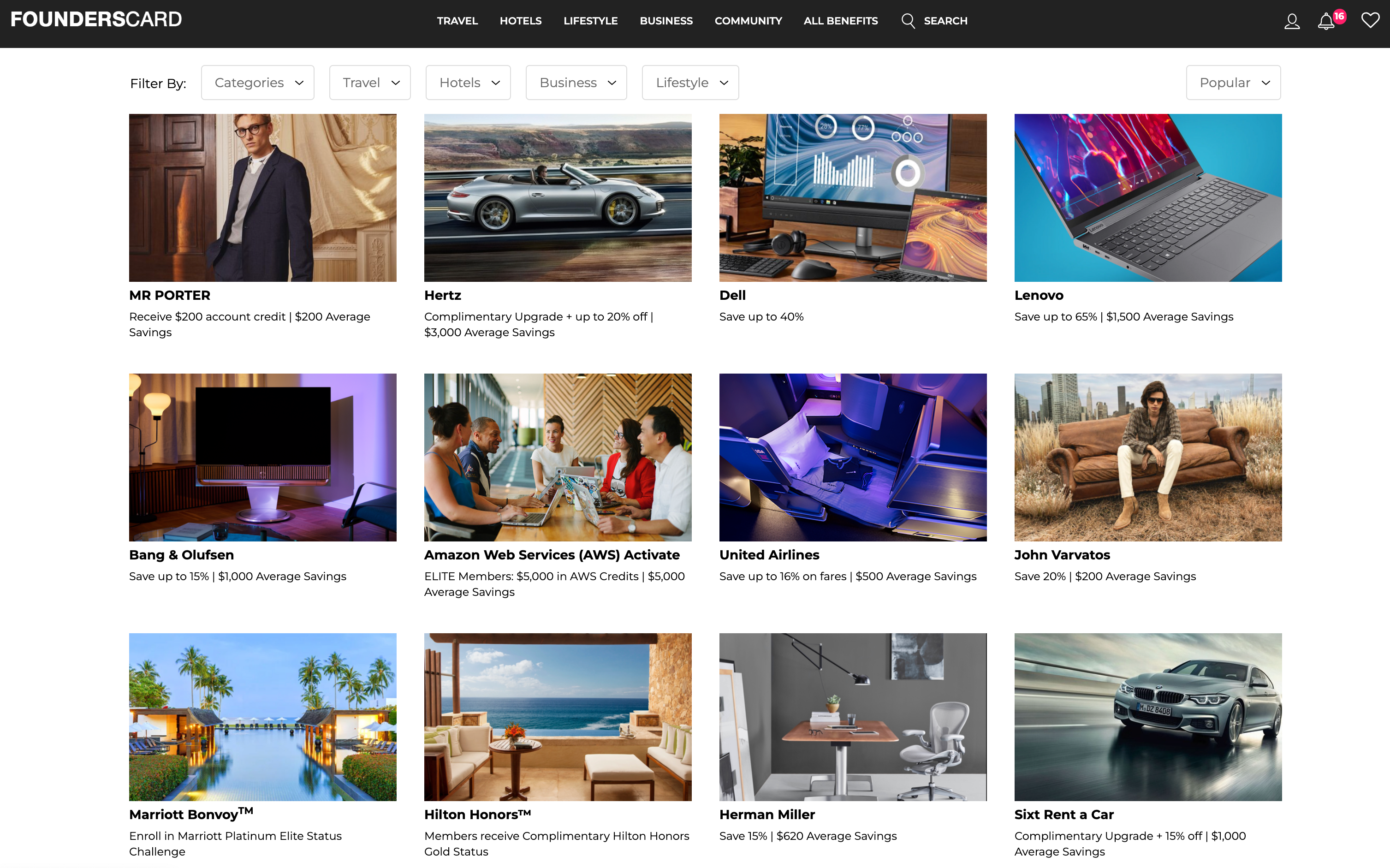

FoundersCard has over 500 benefits that are broken into categories such as travel, shopping subscriptions and business services. Membership gives you elite status and benefits similar to those offered by premium travel rewards credit cards without adding another credit card to your wallet. Some of these benefits include:

- Benefits for businesses: Save up to 35% on business services like Amazon Web Services, co-working spaces, Shopify, Square and UPS.

- Car discounts: Receive discounts for Audi, BMW, Mercedes-Benz and Jeep.

- Cellphone discounts: Save up to 15% on your AT&T bill.

- Hotel status and partner partnerships: Enjoy Hilton Honors Gold status and a status challenge for Marriott Bonvoy Platinum Elite status. Additionally, FoundersCard has hotel partnerships through which members receive special rates and other elitelike benefits. These luxury hotels are in cities like Los Angeles, Miami, New York and Tokyo and include Mandarin Oriental, Park Hyatt and The Ritz-Carlton.

- Rental car status and discounts: Receive Hertz Five Star status and discounts and status with Sixt and Avis.

- Shopping discounts: Save up to 30% at stores like Adidas, Mr. Porter and Reebok. The discount can be stacked and used with shopping portals, so you can earn points and miles and save money. I use the 30% discount at Adidas frequently to buy gym apparel.

Pairing FoundersCard with credit cards is where you can really get outstanding value.

Airline discounts

FoundersCard has multiple airfare discounts with many airlines around the world, including:

- Alaska Airlines: 5% off base fares

- British Airways: Up to 10% off most round-trip fares originating from the U.S. and Canada

- Delta Air Lines: 10% off

- Etihad Airways: Up to 10% off select fares

- Qantas: Up to 15% off Qantas fares between the U.S. and Australia or New Zealand (must purchase in the U.S.)

- Qatar Airways: Up to 10% off flights originating from the U.S.

- Singapore Airlines: Up to 15% off select flights originating from the U.S.

- United Airlines: Up to 16% off

You can book any cabin for these airlines and receive a discount.

United is my preferred airline to fly, and I hold United MileagePlus Premier Gold status with the carrier. Every time I have used this discount, it has given me exactly 16% off.

It’s important to note that with these discounts, you will still earn miles and spending qualifiers toward elite status with the airline. If you frequently fly one of these airlines and book expensive fares, you could easily save the cost of the FoundersCard membership with just one flight purchase.

You can further maximize the value of this discount by using a cobranded airline credit card to earn miles.

Related: Best United Airlines credit cards

Caesars Diamond status

Note that this benefit may have disappeared as of February 2024, as per Miles to Memories. If this is the case, this greatly reduces the value of a FoundersCard membership.

Caesars Diamond is a very valuable status to have if you frequently travel to Las Vegas or Atlantic City, New Jersey.

You used to be able to status match into Wyndham Rewards and then to Ceasars. Now, you can only status match from Wyndham Rewards to Caesars if you earned Wyndham status through stays or by having a Wyndham credit card.

Some highlights of Caesars Diamond status include:

- Free or discounted hotel stays (this depends on how much you gamble, as Caesars will send you offers to entice you back to a property)

- Early check-in and late checkout

- No resort fees, saving you up to $45 plus tax per day

- Complimentary valet and self-service parking, saving you up to $50 plus tax per day

- Complimentary stay at Atlantis, Paradise Island in Nassau, Bahamas

- $100 celebration dinner, which is an annual dining credit that can be used at restaurants in Caesars properties

The biggest selling point of Caesars Diamond status is the complimentary stay at Atlantis, Paradise Island. The value of this alone covers the cost of the FoundersCard membership. You get four nights free and can buy additional nights at $100 per night. However, you can’t use the free nights during March, April or July. This isn’t an issue for me, as I can use the perk during colder months to escape the chilly Pacific Northwest winters.

Last year, I used the $100 celebration dinner credit at Mr. Chow’s in Caesars Palace; it was a very straightforward process, as the restaurant just took $100 off my total bill.

Related: 15 best hotels in Las Vegas for a Sin City getaway

Other useful benefits

- Dell business discount worth up to 40%: I stack this discount with the Amex Business Platinum card’s up to $400 annual Dell credit. Saving 40% allowed me to get an extra monitor last year with my annual credits.

- Late checkout at IHG properties: This is useful to me, as I don’t frequently stay at IHG properties or hold an IHG credit card to have IHG One Rewards status, but when I do visit an IHG hotel, having a 2 p.m. late checkout time is an added perk.

- Sonesta Travel Pass Gold status: I have stayed at a few Sonesta hotels, but I don’t stay frequently, so having some extra perks for these one-off stays is an added benefit for me.

- Preferred pricing on Equinox: I used to be a member of Equinox, and this preferred pricing saved me around $100 off my monthly membership. If you have The Platinum Card® from American Express, you could pair this discount with up to $300 annual Equinox credit (subject to auto-renewal).

- Complimentary TripIt Pro membership: A very useful app for planning a trip and keeping your itinerary all in one place, this flight-tracking feature comes in handy for frequent flyers like me.

Downsides of FoundersCard

Despite FoundersCard having many great perks and benefits, there are some downsides, including:

- Full list of benefits isn’t viewable before membership: You have to sign up for membership and pay before you can get the full list of benefits and features, so it can be tough to determine how much value you will get from each benefit.

- Steep annual fee: The card has an annual fee similar to that of premium credit cards.

- Offers many benefits that credit cards offer: If you have premium travel cards like the Amex Platinum, you might notice that some of the benefits overlap. FoundersCard also is not a credit card, so you can’t make purchases or earn any miles and still have to pay an annual fee.

FoundersCard is best paired with a travel rewards card to maximize the discounts and earn points and miles.

Bottom line

Many benefits with FoundersCard can be accessed with premium credit cards like the Amex Platinum or the Chase Sapphire Reserve. However, many lifestyle and travel benefits provide me with outsize value worth the $295 I pay annually.

I think this card is worth applying for if you can get a rate under the standard membership cost. You may also find great value in having the card if you run a business and can take advantage of the various business discounts and benefits.

For rates and fees of the Amex Platinum Card, click here.

For rates and fees of the Business Amex Platinum Card, click here.