8 ways to use credit card points to reward employees

If you’re a small-business owner sitting on thousands of business credit card points, which you’ve earned by paying your company expenses, you may be inclined to put those points back into your business. However, if you have no need to use your own credit card rewards to book personal or business travel and you have no pressing need for the points, consider using them as a reward or incentive for your employees.

Rewarding your employees using your credit card points is a cash-free way to recognize hard work without digging into your budget to pay for it.

Redeeming points in someone else’s name isn’t necessarily a straightforward proposition, as you generally can’t transfer points directly to an employee’s credit card rewards account. And using points this way isn’t always — or even often — about getting the most value out of your points; it’s about finding thoughtful and unique ways to reward your employees for a well-done job.

We’ve rounded up eight ways to use your credit card points to reward employees.

Related: Best business credit cards of 2024

Finance a vacation

This is the most obvious use of your points, given that many business rewards card programs are tailored to travel rewards. You can use your Chase Ultimate Rewards points earned using your Ink Business Preferred® Credit Card to book travel in someone else’s name through the Chase Travel℠ portal. Just know that you’ll have to manage some details as Chase notes that “all confirmations and communications will be sent to you.”

You can also transfer Ultimate Rewards points to 11 airline programs:

Chase also partners with three hotel programs:

Daily Newsletter

Reward your inbox with the TPG Daily newsletter

Join over 700,000 readers for breaking news, in-depth guides and exclusive deals from TPG’s experts

All transfer ratios are 1:1 (though there are occasional transfer bonuses), and you must transfer points in 1,000-point increments.

From international business class to Europe to domestic hops around the country, these are some of the best ways to redeem your Chase Ultimate Rewards through transferring to partners.

With other cards, like the Capital One Spark Miles for Business, you can redeem your rewards at 1 cent apiece as a statement credit for travel purchased with the card. For example, if you booked a $400 flight using your Spark Miles Business card, you can redeem your miles at a fixed rate of 1 cent per mile to cover the cost of that flight. Therefore, the flight would cost 40,000 miles.

Pay for concert or sporting tickets

If you have music or sports lovers in your office, send them to a show or game as a sign of appreciation.

There are several ways to use your accumulated points to give the gift of live music or sports events; however, be aware this won’t usually be the best-value option for your points and miles:

- Use your Capital One miles to book tickets to events, including the iHeartRadio Music Festival, the College Football National Championship and MLB Postseason, receiving a value of 0.8 cents per mile redeemed.

- Marriott Bonvoy Moments allows you to bid your desired number of Bonvoy points for events like tickets to the Canadian Grand Prix, Chicago Cubs baseball games, Toronto Maple Leafs ice hockey, and the NFL draft.

- Use your Chase Ultimate Rewards points to book experiences, including theme park tickets and Broadway shows, at a rate of 1 cent each. From time to time, one-of-a-kind events hosted by Chase, like tickets to the Sundance Film Festival, are available through Ultimate Rewards at rates set by Chase. Therefore, it can be hard to determine if you’re getting a good deal, and the prices can be hundreds of thousands of Ultimate Rewards points.

- Buy Ticketmaster gift cards. This gives you the least value but affords your employees the most choice when it comes to concert-shopping. Purchase Ticketmaster gift cards using Membership Rewards points earned with cards like The Business Platinum Card® from American Express. The redemption rate is a measly 0.5 cents per point, but again, maximum value isn’t the primary goal here.

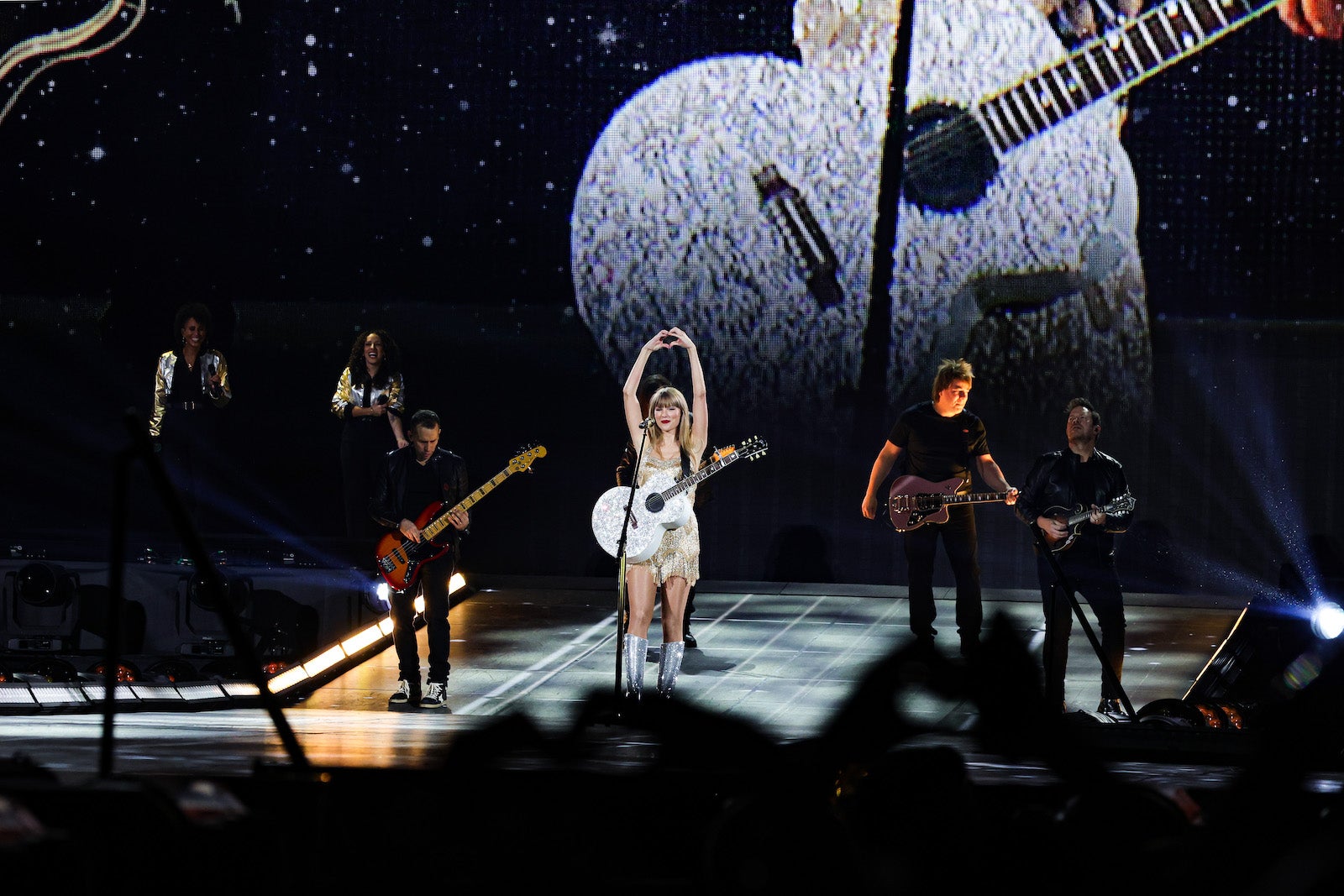

Related: How points and miles saved me from missing the Taylor Swift Eras Tour

Rent a luxury car

You may not be able to buy your top seller a new car, but you can redeem Capital One miles for flights, hotels and rental cars.

The Capital One Venture X Business offers new applicants 150,000 Capital One miles after they spend $30,000 in the first three months from account opening.

TPG values Capital One miles at 1.85 cents each, making this bonus worth an impressive $2,775. If you can meet the steep minimum spending requirement, the full bonus alone is valuable enough to justify paying the card’s $395 annual fee (see rates and fees).

You’ll also earn 10 miles per dollar on hotels and rental cars purchased through Capital One Travel, 5 miles per dollar on flights purchased through Capital One Travel and 2 miles per dollar on all other purchases.

You can redeem Capital One miles to reimburse yourself for virtually any travel-related purchase charged to your card within the last 90 days. For example, to redeem Capital One miles at a fixed rate for a $100 rental car charge, you’d need to redeem 10,000 miles.

Related: How you can redeem points and miles for car rentals

Pay for flight upgrades

Sending your crew on a business trip but want them to know you’re looking out for them? Upgrade their travel to business or first class using your points or miles.

The upgrade policies vary per airline — and remember you can only upgrade if there’s room and if the ticket is booked in an eligible fare class — but you’ll almost certainly have to kick in a few bucks in copay fees on top of the points or miles you’ll use.

Upgrading from discount economy to business on American Airlines, for example, will cost you 15,000 AAdvantage miles plus $175 each way for travel within the contiguous 48 states; from North America to Europe, the charge is 25,000 miles and $550.

Related: How to get an upgrade when flying on major US airlines

TPG Senior Editorial Director Nick Ewen offers the following tips when looking to upgrade with U.S. carriers:

- Look for transcontinental flights: Upgrade charts don’t differentiate between short- and long-haul flights within the U.S., so using miles to upgrade a cross-country flight gets your employees more time upfront, and they may be able to enjoy a lie-flat bed with direct aisle access.

- Upgrade last-minute flights: Sometimes, booking flights within a week or two of departure forces you into higher fare classes. Since American and United Airlines charge copays for deeply discounted economy tickets (and Delta Air Lines doesn’t allow upgrades on basic economy), last-minute tickets often give you additional flexibility when upgrading with miles.

- Upgrade just one leg: If you don’t have enough miles for upgrades in both directions (or if you want to avoid a second copay), consider whether you’d rather score an upgrade on your outbound or return flight.

Buy something fun for the office

With the Chase Ink Business Cash® Credit Card, you’ll earn 5% cash back on the first $25,000 you make in combined purchases each account anniversary year at office supply stores and on internet, cable and phone services. Plus, you’ll earn 2% cash back on the first $25,000 you make in combined purchases at gas stations and restaurants each account anniversary year. You’ll also earn 1% cash back on all other purchases, including on spending over $25,000 each account anniversary year in the 5% and 2% categories.

Consider rewarding your employees with some new items for the breakroom. You could earn 5% cash back at Staples office supply stores — here are some ideas for your next purchase:

You can also redeem the following points on Amazon for the following values:

- Chase Ultimate Rewards: 0.8 to 1.5 cents per point

- Amex Membership Rewards: 0.7 to 1 cent per point

- Citi ThankYou Rewards: 0.8 cents per point

- Capital One: 0.8 to 1 cent per mile

- Hilton Honors: 0.2 cents per point

- IHG One Rewards: 0.2 cents per point

- Marriott Bonvoy: 0.25 to 0.33 cents per point

Be aware that the point redemption values are low. If you’re determined to use your points to buy something your employees can enjoy at the office, you’ll probably be better off redeeming your points for cash.

Related: How to redeem your points and miles for Amazon purchases

Book a hotel stay at home or overseas

The Marriott Bonvoy Business® American Express® Card is a great small-business card for Marriott Bonvoy fans. It comes with an annual free night at hotels (up to 35,000 points) and helps business owners boost their Marriott elite status by offering 15 elite night credits every year.

If the hotel you book has a nightly rate of 40,000 Marriott points and you have a 35,000-point award certificate, you can use your free night award to partially cover the cost of one night and pay an additional 5,000 points, opening up plenty of great ways to redeem points.

You could redeem your Marriott Bonvoy points for a team getaway or reward an employee, perhaps as a congratulations for a promotion or major life event.

Whether you choose to book an inexpensive budget brand hotel in the United States or a luxury property on an exotic island, it is easy to get great value from your Bonvoy points — as well as treat your staff to free nights.

If you’re using a Chase-branded card that earns Ultimate Rewards points, remember you can transfer these points to World of Hyatt, one of TPG’s favorite hotel transfer options.

Buy gift cards

Using your points to buy gift cards may be especially appealing if you want to give a little something to a lot of employees. Just know you’ll get a limited redemption value no matter the credit card program you’re using.

Some programs provide a better return for your points than others. If you want to redeem your points or miles for gift cards, here are some options to consider:

- Citi ThankYou Rewards: Redeem at a rate of 1 cent per point.

- Chase Ultimate Rewards: Redeem at a rate of 1 cent per point.

- Capital One miles: Redeem at a rate of 0.8 cents per mile.

- American Express Membership Rewards: Redeem at a rate of 0.7 to 1 cent per point for merchant-specific gift cards and 0.5 cents per point for American Express gift cards.

- Southwest Rapid Rewards (only for Rapid Rewards cardholders): Redeem at a rate of 0.33 to 0.67 cents per point.

- Marriott Bonvoy: Redeem at a rate of 0.4 cents per point for Marriott gift cards and 0.2 to 0.33 cents per point for other gift cards.

- Wyndham Rewards: Redeem at a rate of 0.33 to 1.14 cents per point.

- Choice Privileges: Redeem at a rate of 0.31 cents per point.

- United MileagePlus: Redeem at a rate of 0.3 cents per mile.

Related: What credit cards should you use to purchase gift cards?

Donate points

If you’re feeling altruistic — and your company culture supports charity work — you may consider donating points or miles in an employee’s name. Most major U.S. carriers have miles donation programs, as do several credit cards.

Amex cardholders can donate Membership Rewards points at a 0.7-cents-per-point valuation to thousands of charities and causes through a longstanding partnership with JustGiving. Even better, the portal allows you to donate points for all or part of the donation amount without needing a specific increment.

While it’s not the highest-value option out there, if you’re sitting on many points and wondering what good you can do with them, this could be an option.

Bottom line

There’s no single “right way” to say thank you to an employee for doing a good job. But if you’re looking for a unique way to reward someone without cutting a check, your credit card points and miles can be put to good use, especially if you earn lots of points through business expenses.